Is 24options a reliable broker? Find out in this review

With so many brokers in the Forex industry, one needs to be very careful while choosing a broker as there is nothing worse than getting stuck with a terrible one. 24Options can be one of these kinds of brokers. It was established in Belize in 2010 and is regulated by the local financial authority. Many 24Options opinions state that the broker is a scam or a fraud. It offers Forex and CFDs trading to its customers. The minimum deposit with the broker is ZAR 3400, leverage is pretty high – 1:500 and the spreads start from 0.9 pips for the premium account and is as high as 2.3 pip for a regular account. The payment methods are diverse and one can have multiple currencies on one account. On the shady side, the withdrawal is complicated and the broker charges fees. Make sure to read the detailed Option24 review to learn everything you need to know before you consider trading with the broker.

24Options broker overview

24Options FX brokerage is operating under the company Richfield Capital Limited. The brokerage was established in Belize in 2010 and is regulated by the International Financial Services Commission of Belize. The license number displayed on the website is valid. The fact that the broker has a license doesn’t already mean that it is trustworthy. There are several things to consider. First is the fact that the brokerage is based in Belize, classifying it as an offshore company, at the same time the Belize financial regulator is not one of the most trusted and recognized ones. Last but not least, the broker does not have regulations from the authorities of other countries – meaning that trading with them contains high risk.

The reputation of the broker is not something that 24Options can be proud of. For a long time the company was a binary options broker and does not have a very clean history, therefore 24Options scam can be a real thing. In 2013 the Ontario Securities Commission added the company behind 24Options.com in a warning list, in 2016 the French AMF banned 24Options from operating in the country, last but not least, FPA traders court voted against the company in 2016 and in 2018, in both cases FPA recommended traders to be extremely cautious when dealing with 24Options. Currently, the broker does not offer its services in the European Economic Area, Switzerland, USA, Canada, and some more regions.

24Options.com review

24Options.com review

Even if you do not know the background of the broker the first impression of its website already makes you suspicious about the 24Options fraud. The dark design of the website with the gold elements looks somehow unpleasant. Content-wise, the website does not have many categories and pages. Landing time from one page to another is slow, but navigation is easy, as there aren’t too many pages. The variety of languages is not so good, the broker offers only four of them – English, Spanish, Russian and Arabic. The good thing is the broker has a Facebook account with a wide audience and is pretty active.

Education

Education

I was happy to see the education category on the website, as I like to see that the broker is trying to educate its traders. But unfortunately, I was easily disappointed when I checked it. There is a daily market report with an economic calendar and trading central, but you need to be registered to access it. The broker offers an advanced interactive Ebook. CFDs and Forex VOD with 00:30 long videos and one page content for analysis. The broker also hosts webinars, you can see the schedule on the website and register for it. On the main page there is a video library which was one of my last hopes in terms of education, however, it turned out to be nothing but powerpoint presentations with text on it. Overall, 24Options.com review was disappointing, now let’s see what the broker has to offer in terms of the service.

What 24Options has to offer

24Options offers to trade with five asset classes, there is no information on how many trading instruments does the broker offer overall. The asset classes are as follows:

- Currency pairs

- CFDs of cryptocurrencies such as Bitcoin, Litecoin, Ripple, Ethereum and more

- CFDs on commodities such as Gold, Silver, Zinc, Sugar, Palladium and more

- CFSs on stocks including Apple, Alibaba, Amazon, Boeing, Baidu, Berkshire and more

- Indices

Spreads

Spreads

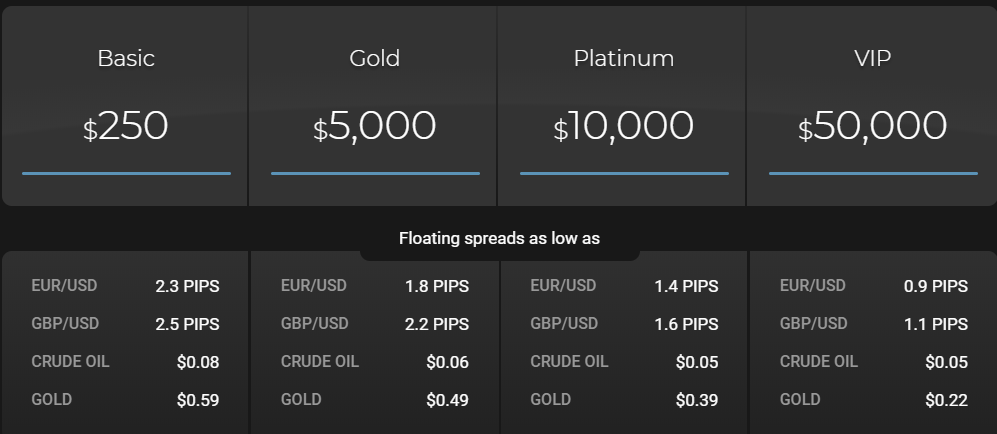

Spreads that you can have with 24Options depend on your account type. It can be as low as 0.9 for major currency pairs such as EUR/USD if you have the VIP account, but, if your account is basic, the spread is from 2.3, which is quite bad. Most brokers offer spreads of 1 pip or even low, on basic accounts. This decreases the 24Options rating even more.

Minimum deposit

Minimum deposit

The minimum deposit with the broker is about ZAR 3400. It is higher than what many good brokers offer but some of them do have higher minimum deposits. Hence 24Options minimum deposit is not the best but is not the worst as well.

The broker offers different payment methods: Bank transfer, Credit/Debit cards, Skrill, Paysafe, Safecharge, eMerchant, MoneyNetlnt, Acapture, Okpay, Perfect Money and Gateshop. The last three providers are unregulated. One can deposit money in the following currencies: USD, GBP, JPY, Euro and the Russian Ruble. Traders can use several currencies for one account.

Once your payment is received with the 24Options system it will appear on your trading account, however, with a wire transfer, it might take five business days.

Leverage

Leverage

The maximum leverage on 24Options is 1:500. As I always say, traders should be beware of high leverages if they are not well experienced as it might result in a huge loss.

Withdrawal

Withdrawal

24Options withdrawal is not the easiest thing on earth. First, the customer needs to fill the withdrawal form – which is a normal process. Next is providing legal documents that 24Options request.

- You need to provide your official ID with a picture, it can be a passport, driver’s license or official ID document.

- Proof of address – it can be a bank or credit card statement or utility bill from the last 6 months.

- If you have used a credit card for depositing the funds, you need to show the front and back of the card showing the last 4 digits only. If you have used several credit cards for depositing funds you will need to provide all of them.

Withdrawal will not be confirmed until all the requested documents are provided. When I see that the withdrawal process is this complicated I always get suspicious and suspecting the 24Options scam all over again. There’s more! There are withdrawal charges, for USD/EUR/GBP/CHF withdrawal fee is 35 USD. Only the platinum account does not charge fees. Other withdrawal fees are as follows: Credit card: 3.5 %, Skrill 2%, Neteller – 3.5%, Wire – 35 USD/EUR/GBP. Very few brokers have withdrawal fees, but unfortunately, 24Options is not one of them.

Fees and commissions

Fees and commissions

The more I learn about the broker more I think that 24Options scam can be a reality. Apart from the withdrawal fees, the broker also charges monthly maintenance fee which is 10 EUR, does not matter if you are using your trading account or not, because if you are not, you will still be charged with an inactivity fee. Inactivity fee is applied after a trader is not active for a period of two months. From the second month to third the inactivity fee is 80 EUR, from 3 to 6 months – 120 EUR, over 6 months 200 EUR. Usually, the brokers that have inactivity fee apply it from 90 or 180 days for being inactive and the charge is very low compared to this.

24options trading accounts

24options trading accounts

24Options Forex broker offers four types of trading accounts, let’s see what each of them includes:

- Basic account. The minimum deposit for a basic account is $250. It comes with 1 basic lesson and one free withdrawal fee.

- Gold account. The minimum deposit for the Gold account is $5.000. It comes with 2 basic lessons, one monthly webinar, and one monthly free withdrawal.

- Platinum account. The minimum deposit for the Platinum account is $10.000. It comes with three advanced lessons, two monthly webinars, and three monthly free withdrawals.

- VIP account. The minimum deposit for the VIP account is $50.000. It comes with five advanced lessons, five monthly webinars, and free withdrawal.

All of 24Options account types have daily news, trading central and trading central SMS alert. Interestingly the spreads are different for each account type. Once you open an account with the broker you can get a demo account. 24Options demo account is limited to only 7 days and one can get $100.000 virtual money on the account.

24Options support

24Options support

To get help from 24Options you can use the live chat, it requires your email and name. When I opened the chat I didn’t have to wait too much, around 5 minutes or so. I got professional assistance, but as I requested basic information the support was pushing on creating the account with them which I obviously did not like, however, the support was very polite. Overall it is nice to know that you can get a response in a short time, which adds up points to the 24Options rating.

Is 24Options legit?

Is 24Options legit?

As the broker is registered and regulated by the financial authority I can say that it is somewhat trustworthy. But can 24Options truly be trusted? The broker has a relatively high minimum deposit, high spreads for the basic account and has many charges and commissions including withdrawal fees. After reviewing its website and features I would not recommend it to anyone. If you are trying to find a good, reliable broker that will help you benefit from your trades – and I am sure you would like to have this kind of broker – then I advise you to keep searching.

[RICH_REVIEWS_SNIPPET category=”page”] [RICH_REVIEWS_SHOW category=”page”] [RICH_REVIEWS_FORM]

Comments (0 comment(s))