FBS Forex broker review, is it a legit broker or fraud?

FBS Forex broker brands itself as the safest and reliable FX broker, but the customer reviews are claiming differently. In this FBS review, I will provide detailed information about the broker features to see if it is legit or if you should stay away from it.

The broker was established in 2009 and has 10 years of experience on the Forex market. It is regulated by the International Financial Services Commission of Belize. The broker offers Forex and CFD trading. Overall it suggests only 46 instruments which are very few. The minimum deposit is ZAR 14, payment methods are various and there are commissions applied on some of them, commissions apply on withdrawals as well The leverage is as high as 1:3000, spreads are from 0.5 but are not very tight for many assets, they can be fixed or floating and broker is charging the commission on it as well. There is more to learn about the broker but most important is to know if FBS scam is real or if the company is legitimate, let’s see.

FBS Broker overview

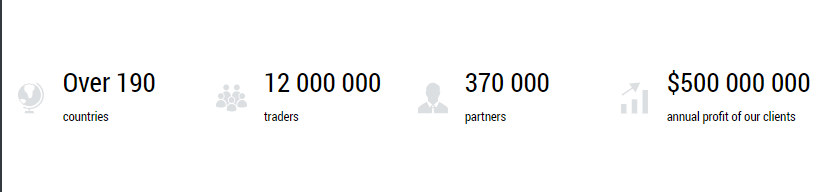

IFBS is a trading name of the broker company FBS Markets Inc. which was established in 2009. The brokerage firm is registered in Belize and is authorized and regulated by the International Financial Commission of Belize. Although the broker is only authorized by the local Financial authority it provides service to international customers except for several countries including Japan, USA, Canada, Brazil, Myanmar, Malaysia, Israel, and Iran. In most cases an offshore regulation, such as Belize is not the best to have so can FBS be trusted? On the website, the broker claims to have service in 190 countries and 12 000 000 traders around the globe. I usually take this kind of bold statements with a grain of salt as it is easy to say it but hard to check. However, the number of proposed customers can easily be checked. My research found out that the 12 million traders are a massive exaggeration.

The broker claims to have received numerous awards since 2009, for example, “Best Safety of Client Funds Asia 2015”, “Most transparent Forex Broker 2018” or “Best investor Education 2017” and many more. I have checked several of them and as I found out most of them are from a single website that organizes annual awards. I would not be so sure about their validity. As it seems the broker tries it hard to showcase itself as the most reliable and honest broker which is not a sin, however with all the misleading information I think that there is a possibility of FBS scam.

FBS.com review

FBS.com review

The first impression I got when I entered the website of the broker is that it is too overloaded. It looks better than other broker websites but is definitely not one of my favorites. The website layout is nice and the navigation is very easy. The landing time from one to another page is fast and works without errors. Another thing I like is the variety of the languages on the website since the broker claims to be international it is expected to have a multilingual website. With FBS you can choose from over 19 European and Asian languages, the variety of choice definitely raises the FBS rating. Content-wise the website is also very good, all the information you would like to get is nicely displayed so you don’t have to search for it too much. The broker has several social accounts such as Google +, Instagram, Twitter, and Facebook where it posts daily. It is one of the advantages as scam brokers do not invest too much time in social accounts and in establishing long time communication with the customers.

Education

Education

One of the 37 awards the broker claims to have was for educating investors so I decided to check it thoroughly. There is an Analytics & Education category on the website that features some educational content that the FBS Forex broker offers. One can find traders’ tools such as Economic Calendar, Forex Calculators and more, there is also market analysis with daily analysis and Forex news. What I liked the most is that the broker offers a wide selection of Forex education. There is a large choice of Forex Ebooks that are accessible for anyone visiting the website, numerous articles with tips for traders and a large library of short lessons with a transcript for beginners. The broker also hosts free webinars which are accessible to everyone. As I am writing this FBS.com review there are three seminars scheduled that are open for registration. Last but not least, the broker organizes seminars, you can find the information about upcoming seminars on the website – date, venue, agenda and the speakers.

Overall the website with its content and educational materials has left a good impression on me.

What FBS has to offer

Now it is time to see what the broker really has to offer to its customers and rate how good the service is. The broker offers to trade Forex and CFDs. It has several asset classes as follows:

- Forex and Forex Exotic, the first one includes the major currency pairs, for example, EUR: USD, Forex exotic includes the currency pairs that are not commonly traded such as CNH: JPY or even USD: ZAR, overall there are 35 currency pairs available.

- CFDs of metals including palladium, platinum, silver, and gold.

- CFDs of major cryptocurrencies: Bitcoin, Dash, Ethereum, LiteCoin.

- CFDs of over 30 popular company stocks such as Alibaba, Amazon, Coca-Cola, Disney, Apple, Google, Nike, Nvidia, Tesla and more.

- CFDs of crude oil, Brent oil and DAX 30.

The choice of trading instruments is not too bad, but not too good as well.

Spread

Spread

Spreads are very different depending on what kind of FBS account you have and which assets you are trading. The lowest I could find was 0.5 pips. The broker offers floating and fixed spreads as well. Here I need to mention that the broker is charging commissions that vary from $15 to $25 for certain assets. Commissions are never a thing that is welcomed by the traders, therefore, charging it does not contribute much to the FBS rating.

Minimum deposit

Minimum deposit

The minimum deposit with FBS is ZAR 14. It is the lowest it can get, however, the broker offers several types of accounts and hence the minimum deposits are different. I will go back to the account types and its minimum deposits below, before that I’ll mention that the low deposit minimum seems like an amazing feature for beginners.

The FBS FX brokerage offers several payment methods to its customers, you can use Visa, Neteller, Stic Pay, Skrill, Bitcoin by Skrill, Perfect Money, Bitwallet and Astropay. You need to choose the payment methods, in most of the cases the funds will appear on your trading account instantly, only in case of using Astropay will you’ll need to wait 72 hours. In all cases, the currency should be USD or EUR, except with Bitwallet you can deposit JPY and via Bitcoin Skrill, you can deposit Bitcoin. Last but not least – commissions, while depositing via Stic Pay commission is 2,5% + $0.3, there is commission applied while depositing via Perfect Money but it is not stated how much is charged.

Leverage

Leverage

The maximum leverage you can get with the broker is 1:3000 which is pretty high. Thankfully, however, it can be lowered for inexperienced traders’ accounts.

Withdrawal

Withdrawal

Good withdrawal system is a must for a broker that brands itself as a reliable and honest one.

FBS withdrawal is possible via the same payment methods that can be used for depositing your funds. As the broker states the withdrawal request is processed within 1-2 hours on business hours, however, it can last up to 48 hours. With Bitwallet you can withdraw your money instantly after it is processed, with other providers it takes up to 48 hours. Wire transfers take up to 5-7 business days. Sadly, there are withdrawal fees that vary from 1% up to 6% depending on which method the trader chooses. Overall the withdrawal methods are not as easy and comfortable so is FBS safe in this regard?

FBS account types

FBS account types

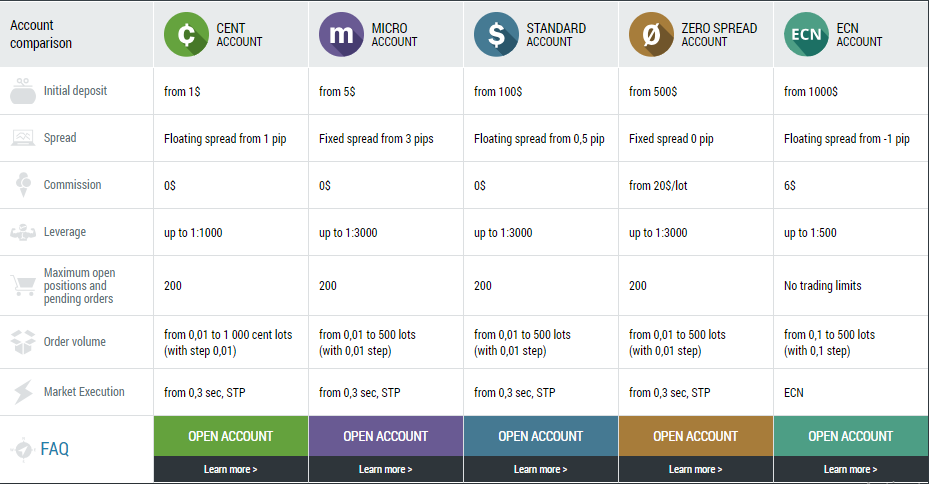

There are five FBS account types one can get depending on experience and trading capabilities. Cent, Micro, Standard, Zero Spread and ECN accounts.

- FBS Cent account – The minimum deposit for this account is $1, it has floating spread from 1 pip and the leverage up to 1:1000. Maximum open positions is 200, order volume – from 0,01 to 1000 cent lots.

- FBS Micro account – The minimum deposit for this account is $5, spreads are fixed from 3 pips which is not very optimal for traders, the leverage is 1:3000, maximum open positions – 200 and the order volume is from 0,01 to 500 lots.

- Standard account – Standard account has the same conditions as the micro account, there are two differences only – the minimum deposit is $100 and there are floating spreads from 0,5 pips.

- FBS Zero Spread account – The same is for this account, the minimum deposit is $500, the fixed spread is 0 pip but there is a commission of $20 per lot.

- ECN account – the minimum deposit for this account is $1000, spreads are floating from -1 pip, there is a commission of $6 and leverage is up to 1:500, also with this account there are no trading limits.

There is an FBS demo account available as well which is limited to over 35 days.

FBS trading platform

FBS trading platform

The broker offers two trading platforms MT4 and MT5, these platforms are the most commonly used and recognized ones. It is comfortable as it runs on all devices and also has WebTrader. However, it would have been nice for FBS to offer cTrader as well which is one of the best trading platforms alongside with MT4 and MT5

FBS support

FBS support

There are two options to get help from the broker, the first option you have is to use live chat. While making the FBS review I tried the chat by myself, It works very well. You need to write your email, name and the question, after which you will be connected to the FBS customer support team. The person on the other side of the chat responded very fast. Although I was asking very basic questions about its services as a newbie I cannot say that I got satisfactory answers. Another option is to request a call back – you can write the time frame you are available for a phone call and your number. I do not like this option much as you need to display your phone number to the broker and you cannot be sure that it will not be used otherwise. It would be so much easier if I could call the broker by myself if I have an urgent request, unfortunately I could not find the phone number on the website or the email address of the support team, which is a very big red flag form me as it can be the sign of an FBS scam.

FBS opinions

FBS opinions

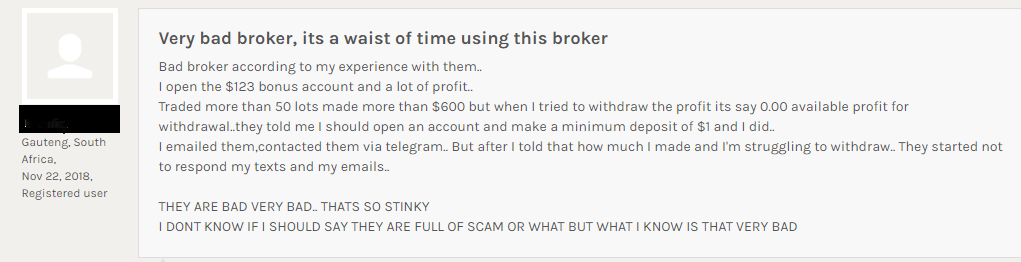

Products, services, and regulation are usually enough to determine the quality of a broker. However, FBS also claimed that 80% of their new customers remain loyal further down the line, so I decided to check some of the FBS reviews made by people who have actually traded with them. I saw both sides of the spectrum, but the majority of the reviews were negative, the bad reviews were mostly regarding the withdrawal as many people had problems receiving it or have not received it at all, here’s one example:

Is FBS legit?

Is FBS legit?

So after all of this, is FBS a legit broker or is it a scam? The broker showcases some features that can be good for the new traders as well as the experienced ones. The low minimum deposit and high leverage, a variety of accounts and recognized trading platforms, as well as rich educational content are some of its primary features. At the same time, the broker claims a number of active traders that is very unlikely to be true, does not have a wide variety of trading instruments and charges a lot of commissions. Also, overall FBS opinions are not something that the broker can be proud of. Last but not least, they are regulated by an offshore regulator. Based on it all, I would not recommend trading with FBS, there are way better brokers with whom your funds will be more secure.

[RICH_REVIEWS_SNIPPET category=”page”] [RICH_REVIEWS_SHOW category=”page”] [RICH_REVIEWS_FORM]

Comments (0 comment(s))