Read FxPro Review before you will make your choice

FxPro markets itself as the number one Forex broker with 15 years of experience and customers from 170 countries. However, FxPro opinions are controversial, while the broker can be proud of some of its offerings, there are still things that the traders are not so excited about.

The brokerage was established in 2006. It is registered in five countries and is regulated by the local regulators such as FCA, FSCA, CySEC, DFSA, SCB. The broker offers six classes of trading instruments to trade with including currency pairs and CFDs on futures, indices, shares, metals, and energies. The minimum deposit with the broker is ZAR 1400, the broker offers several payment methods such as Bank/Wire transfer, Skrill, PayPal and more. Spreads for the most popular currency pairs start from 1 pip and leverage is quite high – 1:500. If you are considering to trade with FxPro make sure to read FxPro review and learn about the broker in detail.

FxPro broker overview

FxPro FX brokerage was established in 2006 and has its headquarters in London, UK. The broker is offering its services to the global market, hence it is registered and regulated by several financial regulators. FxPro UK regulated by the FCA, the UK financial watchdog. FxPro Financial Services Ltd is regulated by CySEC and FSCA. FxPro Global Markets MENA Ltd is regulated by DFSA and FxPro Global Markets Ltd is regulated by SCB. All license numbers can be found on the broker’s website and can be checked with the regulators.

The regulations create a picture that the broker can be trustworthy, however, the number of customers seems a little bit low compared to the years it has been in the industry. After 15 years in the Forex market, the broker has only 870,000 registered customers. However, calling it a FxPro scam is pushing it a bit. In addition, the broker claims to have more than 55 international awards, however, the awards are not listed anywhere on the website so unfortunately, I did not have a chance to check if it is real or not. The only awards the broker is featuring on the websites are the best Forex trading platform award by Investors Chronicle and Financial Times, Best Forex trading tools by QFX, Best Trading Platform Forex Awards and Best Automated Trading Platform by International Finance Magazine Award.

FxPro.com review

FxPro.com review

The first impression I got from the website is that it’s designed to look modern and is very minimalistic with too much negative space. Once you go to the website you can scroll down and find all the information that the broker would like you to know. However, the navigation looks somewhat confusing and gives a sense that the website does not lead you anywhere. Hence, overall it is clearly not my favorite. What I liked about the website – is that it is fast, after all the broker is a sponsor of F1, and most importantly I enjoyed the variety of the languages. There are 23 languages available, it includes European languages such as German, Spanish, Italian, French, Portuguese, and more, as well as Asian languages including Korean, Indian, Japanese, Chinese, Arabic, and more. It definitely raises the FxPro rating for me as it proves that the broker is truly international.

Content-wise, There is not much to see on the website, I could not find any education-related content that I would love to see and even expected from a broker that claims to be the best in the world. Also, no social network pages are mentioned anywhere on the website, however, while writing this FxPro.com review I found their Facebook and Twitter accounts and saw that the broker has a wide audience and is very active with posting on social media. There are things that I liked and disliked about the broker’s website and yet it is hard to say if the broker is trustworthy or not. So let’s see what FxPro really has to offer in terms of service and trading conditions.

What FxPro has to offer

FxPro Forex broker offers 250 + instruments to trade and promises fast execution and deep liquidity. The instruments that the broker offers are categorized into six assets classes:

- Currency pairs with fixed and floating spreads

- CFDs on popular futures such as cocoa, coffee, cotton and more

- CFDs on indices of popular European, Asian and American markets

- CFDs on shares of more than 150 global companies including Apple, Amazon, Coca Cola, Facebook, Microsoft and more

- CFDs on Spot Metals

- CFDs on Spot Energies such as Brent oil, WTI, and natural gas

Spreads

FxPro spreads are from 1 pip for the majority of the most popular currency pairs. As the broker claims there are no commissions or hidden fees. These together create a good opportunity for beginner traders.

Minimum deposit

Minimum deposit

The minimum deposit with FxPro is relatively high and is ZAR 1400, although the suggested minimum deposit from the broker is over ZAR 6900. However, it is up to you how much you will deposit as long as it is more than ZAR 1400. The broker offers several payment methods for funding the account. You can use bank transfer, Visa, PayPal, Skrill, Neteller or UnionPay. For bank transfer, the deposit time depends on the banks involved, otherwise, for all the other payment methods it usually takes up to 10 minutes to get the funds on your trading account. FxPro commission is not applicable to depositing funds.

Leverage

Leverage

The leverage that the broker offers is quite high at 1:500. It can be very good for professional traders who have more skills and experience and at the same time more financial capabilities for trading. The new traders must be very careful with high leverages as it also means that if you lose the trade, you will lose more money. Hence, more is not always better when it comes to Forex trading.

Withdrawal

Withdrawal

FxPro withdrawal is available in the same ways as depositing. It usually takes one working day for the withdrawal request to be processed. As the broker claims withdrawal is free, although there are fees on deposit and withdrawal for those who do not have a VVIP account. In addition to that If you are withdrawing money via Skrill, there will be fees up to 2.6 % if withdrawal is requested without having traded, for the same case there will be up to 2% FxPro commission incurred if you are withdrawing money via Neteller. For the other cases, or other payment methods there are no fees applied.

FxPro trading accounts

FxPro trading accounts

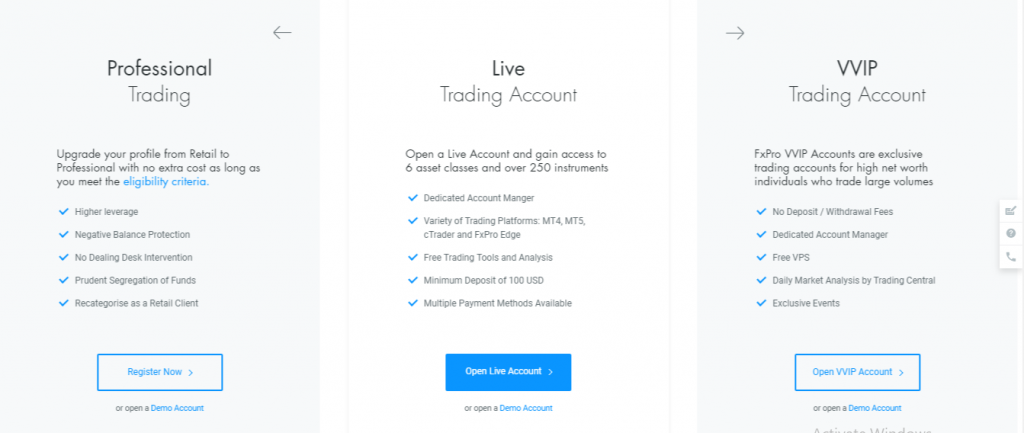

FxPro offers three types of trading accounts. One can have a live account, VVIP account, or upgrade their status from retail broker to professional and hold a professional account.

- Live account – Live account is a standard trading account that FxPro offers, It comes with a dedicated account manager and free trading tools and analysis.

- VVIP accounts are specially designed for high net-worth individuals who trade large volumes. In addition to what the standard account offers those who hold VVIP trading accounts have free VPs, daily market analysis and access to exclusive events.

- Professional trading account – This account is for those who want to upgrade their status from retail to professional trader. There are no extra costs for it, however, the traders must meet the eligibility criteria. The professional trading account comes with higher leverage, negative balance protection, no dealing desk intervention and prudent segregation of funds.

In addition to these three types of accounts, there is also the FxPro demo account available.

FxPro trading platform

FxPro trading platform

There are several platforms that are globally recognized and used by the majority of the traders, these are MetaTrader 4, MetaTrader 5 and cTrader. While many brokers offer one or two of those, it is great to see that FxPro offers all three of them. FxPro reviews made by its customers state that this is an advantage since different customers have different tastes and needs when it comes to trading. Besides the most commonly used platforms, FxPro also offers a custom made platform – FxPro Edge.

FxPro support

FxPro support

Usually, when the broker has a good support system it means that it cares about its customers, it is the case with FxPro. The broker has several ways you can contact them. One can contact the support team via the live chat where you need to indicate your name and email. You can also request a call from the broker and indicate the language. At the same time, you can call the support team yourself.

Is FxPro legit?

Is FxPro legit?

After all, the main question I need to answer is if FxPro scam is real, or if the broker is trustworthy. According to all of the evidence in their history of operations, it is redundant to think of them as a fraud. However, the broker not being a scam doesn’t mean you should immediately register with them. Hence the next important question needs to be answered – is FxPro a good broker? I cannot be that confident answering this question. The broker has some advantages, such as trading assets, a variety of platforms and high leverage, at the same time it has an average minimum deposit, and most importantly commissions on funding and withdrawal which is never a good thing. Hence I would say that the broker is OK, but as a trader, I would definitely see other options.

[RICH_REVIEWS_SNIPPET category=”page”] [RICH_REVIEWS_SHOW category=”page”] [RICH_REVIEWS_FORM]

Comments (0 comment(s))