Comprehensive Equiity Review – All the facts you need to know about this Forex broker

Equiity is a regulated Forex and CFDs broker offering diverse assets and relevant security measures to protect its clients. Among all the necessary things, a well-established broker must have decent trading conditions without any hidden fees and multiple accounts to appeal to different types of trading methods.

Equity offers all of this with several trading accounts, each of which comes with an Islamic or swap-free option, offering flexibility and increasing the diversity for traders of all kinds and types. The minimum deposit is moderately average, and the minimum lot size allows traders with all budgets to trade confidently with their preferred risk levels.

The leverage system is among the most reasonable and metals can be traded with 1:200 leverage similar to Forex pairs. As we have mentioned the broker offers CFDs of contracts for differences for all its provided asset classes meaning traders can speculate on both directions of the price.

With all the benefits offered, let’s dive in and describe Equiity services in more detail below to make it clear to our readers if the broker is the one they need.

Equity Forex broker quick overview

The broker is registered in Mauritius and Cyprus but is regulated only in Mauritius. The Financial Services Commission of Mauritius also known as MU FSC is the regulator under which the broker operates. In Cyprus, the broker is registered as a licensed payment services provider. The main company that owns and operates the Equiity website is MRL Investments (MU) LTD. The broker seems young and has put some serious effort into developing its proprietary trading platform with modern design language and diverse functionality. Equiity is not offering CFDs or Contracts for Differences to the citizens of the USA, Iran, Canada, Iraq, and North Korea.

What Equiity has to offer – trading assets

Equiity provides access to a multitude of trading instruments in diverse assets including Forex pairs, metals, indices, commodities, stocks, and cryptos. All the assets offered by the broker are in the form of CFDs or contracts for differences. CFDs are great speculation instruments, allowing raiders to be profitable in both directions and enjoy higher execution speeds.

There are more than 50 currency pairs including multiple exotics, ensuring traders can access any currency pair they prefer for trading.

Spreads

Equiity offers dynamic spreads starting from 1.4 pips for major pairs on its platinum trading accounts. What sets this broker apart from many others is its low spreads on commodities, which is the same as for Forex. Especially low spreads are offered for crude oil from 1.4 pips, just like Forex spreads. The industry average spread for Forex trading is around 1 pip, which places Equiity’s spreads in the average range. This spread is more than enough for any day trader to speculate on FX markets commission-free, as Equiity only makes money from spreads and does not charge any additional fees.

Minimum Deposit

The minimum deposit required by Equiity for the Silver trading account starts from 250 USD or EUR, depending on the base currency. Considering that some popular brokers offer 0 USD as a starting point, this amount is a bit higher. But for convenient trading and to make a living from trading, this is a fairly low amount of capital. The minimum trading lot size is also set at 0.01 lots, which is very convenient to start trading low and increase lot size together with more experience. With 1:200 leverage on FX pairs and 0.01 lot size, the minimum capital required to open a trading position is around 5 USD (0.01 lot equals 1000 USD). We will delve into Equiity’s dynamic leverage system below in more detail.

Leverage

The leverage system is very reasonable for Equiity making it possible to trade with decent leverage levels without risking the exposure for overleveraged trading. This is especially critical for newbie traders, who tend to overlook many important things, including the strict control of leverage you need as a trader to succeed.

Equity’s leverage levels are the same for all trading accounts.

For FX pairs, the maximum leverage traders can get is capped at 1:200 which is more than enough to control considerable trading position size. For metals, other commodities, and indices, the maximum leverage traders can get is at 1:50, stocks and equities CFDs are set at 1:10 max leverage, and cryptos come with the lowest leverage of 1:5.

Withdrawal

Deposits and withdrawals at Equiity can be made through several popular methods. Visa and MasterCard are both accepted by the broker and deposits are instant. For fast withdrawals, traders are advised to use online payment methods such as Skrill and Neteller, as they are known for their short withdrawal processing times.

Equiity account types

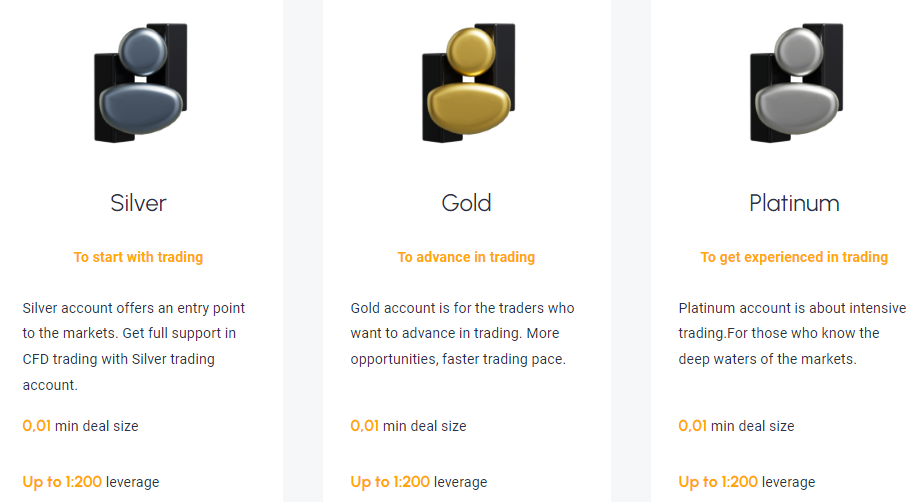

Now let’s discuss one of the most important things for traders, which is trading account types. The broker may be perfect, but if it does not offer a trading account that suits your trading strategy, it would be difficult to open a trading account. Equity offers three trading accounts Silver, Gold, and Platinum, and they all come with an Islamic account option. The minimum lot size for all accounts is set to 0.01 lots, enabling trading with conditions similar to micro-accounts. The same is true with the leverage, as all accounts come with the exact leverage conditions.

-

Silver Account

The silver account is an entry-level trading account with all the basic features any trader may need. It comes with the highest spreads from 2.5 pips for major pairs and crude oil and is slightly expensive to operate. Gold trading comes with 7.4 pips spreads, and minor pairs will cost around 3.6 pips for trading. Now, these spreads are a bit high, which is why the broker also offers different accounts with lower costs. As for trading services features, the Silver account holders can only enjoy dedicated support and are allowed to use hedging in trading.

-

Gold Account

The Silver account is a middle ground between gold and platinum trading accounts, as it offers the majority of services and medium spreads. These services include a dedicated account manager, webinars, videos, a swap discount of 25% for silver accounts, dedicated support, and hedging. The spreads are even lower on the gold account when compared to the silver account. Major FX pairs and crude oil spreads start from 2 pips, for minor pairs from 2.8 pips, and 5.6 pips for Gold (XAUUSD). These spreads are attractive for commodities trading.

-

Platinum Account

For the lowest spreads and better conditions, platinum offers the best terms for trading.

Spreads for major pairs start from 1.4 pips, for minors at 1.6 pips, for crude oil from 1.4 pips, and 13.8 pips for gold trading. All services are available for the platinum account holders, including an extra News Alert feature allowing traders to always be informed about important upcoming economic indicators. These indicators known as fundamental indicators are known for their ability to shake the FX markets, and knowing when to await them can be an effective way of avoiding extra risks during trading.

Equiity Trading Platform

Equiity has developed a proprietary trading platform that is web-based and has a modern design with all the needed functionality. The slight disadvantage is there are no other popular platforms like MT4, or MT5 offered, although the web platform is suitable for all devices including mobile and desktop.

Equiity support

The support is offered through several channels including live chat, email, and hotline available with support networks in several countries. The live chat is the easiest and fastest way to connect with the broker representatives and resolve any issue or get any information. The website and support are both multilingual, making it fast and convenient.

Is Equiity a legit Forex broker you can trust?

In conclusion, Equity is a Forex and CFDs broker with strong regulations that offer a diverse range of assets and competitive spreads. With its flexible account options, dynamic leverage system, and proprietary web trading platform, Equity aims to offer traders a comprehensive trading experience. With all the services and features researched, Equiity seems like a reliable option for traders who need commission-free trading.

Comments (0 comment(s))