Everything about Novox FX Forex broker in detailed Novox FX review

Novox FX is a Forex broker that offers to trade with over 50 currency pairs, commodities, stock indexes and precious metals. The company is operated by Novox Capital Ltd – registered in Cyprus and regulated by the CySEC. The foundation date of the Novox FX itself is not mentioned anywhere. The broker is very mysterious, the website does not provide much information about the broker and Novoxfx reviews and opinions are nowhere to be found.

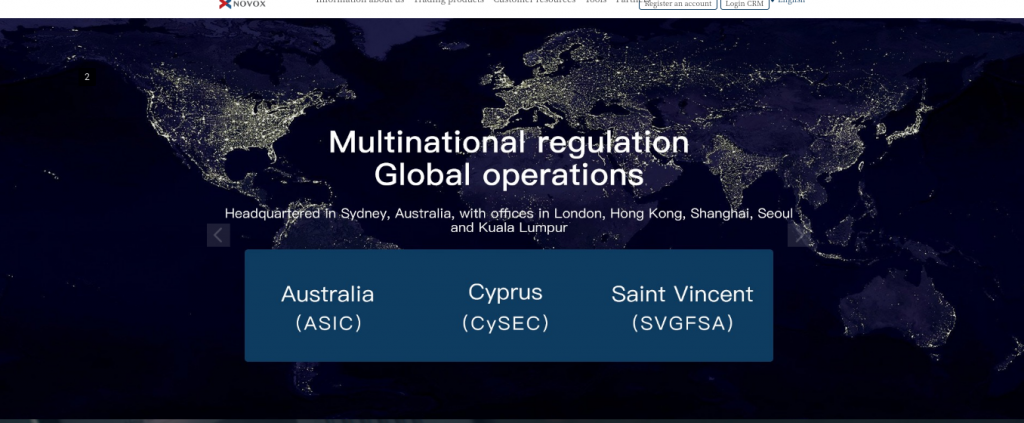

The website of the broker can be viewed in Chinese, Japanese, and English, according to this, I assume that the broker provides service to Chinese and Japanese citizens but does not have local regulations. It is unknown where else does the broker operates but as it itself claims the offices of the brokerages are in Sydney, London, Seul, Hong-Kong, Shanghai, and Kuala Lumpur. There are many inconsistencies between what the broker claims and actual reality which points out the possibility of Novox FX fraud. This review will provide detailed information about the broker, the company that operates it, the regulatory side and the features and service of Novox FX to answer the main question – if the broker is trustworthy of a scam.

Company regulations

Company regulations

Novox is a trading name of the Novox group. The company consists of two companies. One is Novox Global Limited which is registered in Saint Vincent and the Grenadines and has a license from the local regulator. It is not the regulator that a trader can trust with the eyes closed as the companies registered and regulated offshore are always suspicious. The company is registered as an international business company. Novox Group PTY LTD is the authorized representative in Australia: CARDIFF GLOBAL MARKETS PTY LTD. It is regulated by the financial authority of Australia – ASIC with the license number 439907. The license was issued back in 2010 and is still valid till 2020. The other company Novox Capital LTD is registered in Cyprus and has a license from the Cyprus Securities and Exchange Commission. The license number is indicated on the website of the CySEC and is valid. After seeing the regulations one might not question is Novox FX legit or not. However, it is still early to judge it. The CySEC website indicates that the regulation is for the Novox Capital LTD and the website of Novox itself is not listed as one of the approved domains. In addition to this, Novox Capital Ltd does not have a very clear history and it is worth checking before any trader decided to open an account with Novox.

Novox Capital scam history

Novox Capital scam history

Novox does not have a history the company can be proud of. There have been several cases when the broker was fined by the regulator and traders have called out for the Novox Capital scam. Let’s dig deep into the company background and see what is behind the broker. In recent years Novox Capital Ltd has been running several binary options platforms that are either closed or banned today. Options888, OptionStars, SafeMarkets, ZoomTrader, ZoomTraderGlobal, OptionStarsGlobal, OptionBit these are the trading platforms that the broker was either running or was associated with. Some of those platforms, for example, Options888, ZoomTrader, OptionBit, and ZoomTraderGlobal were targeted by the regulatory bodies in Europe, Asia and North America. The broker was repeatedly fined by the CySEC with the big fines, however, the license of Novox Capital Ltd is still valid and has not been revoked at any time, which is very alarming. Out of these companies, the one that drove the most attention from the traders as well as from the regulator is OptionBit.

The company behind Novox FX Forex broker – Novox Capital Ltd was fined in 2017 by the CySEC. The broker failed to meet the regulations on several occasions and had to pay 175,000 EUR. Some of the failures include:

- providing advice on investment services without having authorization by the regulator. According to the CySEC website, the company registration only allows it to enable transmission of orders from customers to liquidity providers and to execute the orders on behalf of their customers. The fine for violating the regulation was 70,000 EUR.

- Another 30,000 EUR the broker had to pay for misleading customers with the false/unclear information. As CySEC stated, in the call centre of the company the representatives of it were giving the information that was either a lie or information that would confuse the clients to lure them into making a deposit. Which was a common strategy of many brokers that offered binary options and clearly it was also a part of Novox FX fraud.

- 30,000 EUR was for not meeting the interests of the clients. There has been an accessive number of customers that had multiple complaints about misrepresented market information and delayed withdrawals. The regulator decided that the broker was not acting in the interest of their clients.

- Novox Capital also had some of the violations that are very disturbing, for example, the company failed to protect the privacy of the customers and was providing third parties with the information of the customers. Third parties included customer service agents and call centres. The company did not provide a warning to the clients that the binary options trading involved high risks. The regulator required from all binary options brokers to inform customers about the risks associated with the trading of this particular instrument. Instead of warning clients, the representatives of call centres were convincing clients that they would receive high profits without failure. Last but not least, the company did not keep an accurate record and did not have a necessary control of the advertising materials. For all of these failures, the broker was fined with 45,000 EUR.

Only several weeks after this fine, Novox Capital Ltd was fined again with an additional 5000 EUR for failing to inform the regulator about the material change of the broker name and domain of the website. The fact that Novox broker is the daughter brokerage of the company that is associated with the binary options brokerages that have been fined multiple times rises the question can Novox FX be trusted even tho it is regulated? Let’s take a closer look at the services of the broker to decide.

What does Novox FX offer to the customers

What does Novox FX offer to the customers

The broker offers to trade Forex with approximately 50 currency pairs including currencies such as the dollar, euro, pound, the Swiss franc, the Canadian dollar, the Australian dollar, and the New Zealand dollar. Apart from it, the customers of Novox FX brokerage can trade currencies of emerging markets, for example, an Indonesian Rupiah or Turkish Lira. The other trading instruments include Crude oil and Brent crude oil, stock index and precious metals including gold, silver, platinum and palladium.

Novox FX Account types

Novox FX Account types

The broker offers three types of accounts to its clients: Standard, VIP and professional account. The minimum deposit for a standard account is 200 USD, the broker claims that spreads start from 0.25 pips but we will go back to the spreads again. The VIP account is available from 5,000 USD with spreads from 0.20 pips. As for the professional account, the minimum deposit is 10,000 USD and the spreads start from 0.12 spreads. The broker does not show any more information about the account types and if there are any additional requirements for opening the professional account. As in Europe, the practice of offering the status of professional trader is very strict and the broker is required to review the trading portfolio and records of the customer. Offering the professional account to any of the traders who are willing to have it might as well be the part of Novox FX scam scheme.

Spread and leverage

Spread and leverage

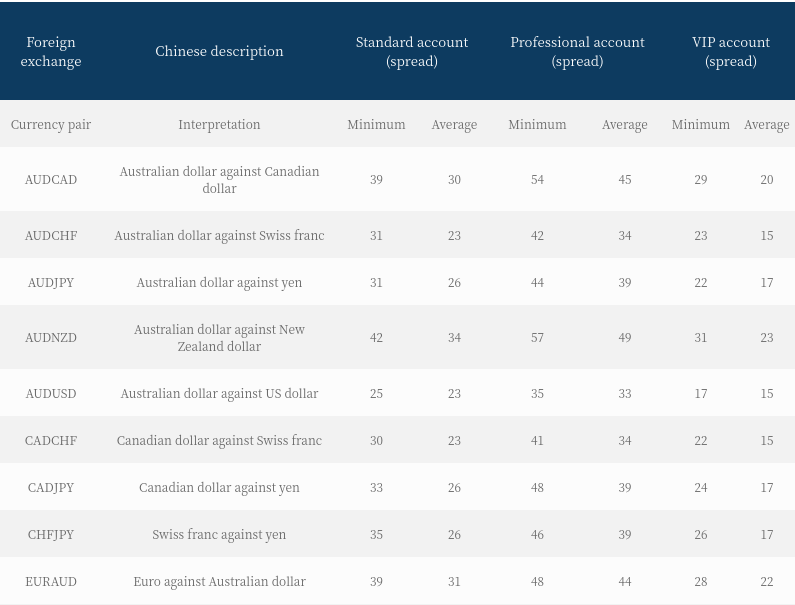

Now let’s talk about the spreads. As I mentioned above the broker states that the spreads for Standard, VIP and professional account types start from o.25, o.20, and 0.12. It sounds great right? The spreads look very nice and while viewing the account types inexperienced traders might feel like it is a good idea to trade with the broker. It seems like this is exactly what the broker is counting on to lure the customers. It takes just one click to find out how the spreads really look like. The minimum spread for the standard account for EUR/GBP is 18 pips, for professional account 36 pips, and for VIP – 15 pips. And it is the lowest I could see. The maximum is for EUR/TRY – for standard account 528 pips, for professional account 558, and for VIP – 493 pips. Not only this is hilariously wide spreads but at the same time, there is a huge difference between how the broker represents spreads on the page of accounts and how they really are. This is a very cheap trick to mislead customers into opening account and it again makes me wonder can Novoxfx be trusted? I do not think so. The leverage that the broker offers to the customers is the same for all account types and is 1:500. It is high leverage, which is very dangerous for the beginner traders. Moreover, the broker offers service to the European traders as well, where the leverage cap restriction is 1:30. The leverage of Novox FX is more than 16 times more than the leverage the broker should offer to the residents of the European Union. Hence, it makes the broker very shady and lowers the Novox FX rating even more.

Novox FX withdrawal

Novox FX withdrawal

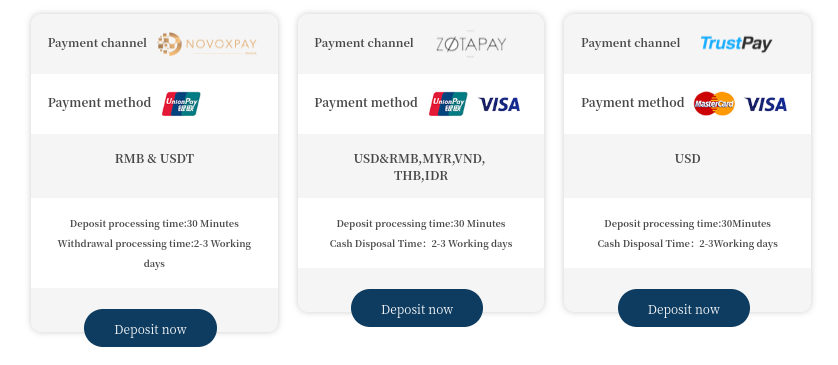

Unfortunately, the broker does not provide much information about its withdrawal policy. Which is already suspicious especially since the other brokerages that belonged to the Novox Capital Ltd had some serious problem with the withdrawals. The way Novox FX describes the withdrawal is not very clear and is somewhat confusing, it makes me think that the broker is using the same tactics for confusing clients. Novox FX withdrawal is possible via several payment methods: Credit/debit card, UnionPay, and wire transfer. However, you cannot use various withdrawal methods if you want to withdraw the money in certain currencies, for example, the US dollar. Overall, the withdrawal policy is designed terribly. The minimum amount of money that can be cashed out is 50 USD and as the broker claims the processing time is 2-3 days which does not sound very well. The broker also states there are no fees for the withdrawal but comments that the corresponding fees will be deducted from the trader’s withdrawal funds.

Novox FX customer service

Novox FX customer service

Now let’s talk about the customer service which is often overlooked by the traders who are searching for the broker. Novoxfx.com review showed that the customer service the broker is providing is pretty much the same as the features of the broker. To say simply, it is very bad. First of all, the Q&A section of the broker, where the traders should be able to see the questions they might have about the brokerage looks very bad. The broker does not understands the concept of the Q&A or simply does not want to display the information about its service in this way. Q&A section only features general questions that will not come up in the mind of even a very beginner trader. For example, in trading issues, there are questions like what is a margin, leverage and lot. So if the broker would remove Q&A at all it would not make any difference for traders. It already forms a very negative Novox FX opinion about customer service.

The options to contact the broker and get assistance are very limited as well. On the “contact us” page the broker has a button for online consultation and claims to have professional online support service 24 hours. Unfortunately, this button does not work at all. There is an option to send an email to the broker but since the consultation service does not work I am not sure if anyone will contact the trader back at all. Last but not least, the broker has the number of customer support on the website, that’s where it is getting more interesting. The number and the address are from Vincent and Grenadines meaning that the company might run from offshore.

Is Novox Fx legit?

Is Novox Fx legit?

Not only Novox FX does not look like a legit company, but there is also a high chance that the Novoxfx scam is real. The regulatory side of the broker is very complicated. As it seems the broker provides so much information about different regulations to make visitors of the website confused deliberately. The website states the broker is multiregulated by the CySEC, ASIC and SVGFSA. However, none of the licenses is for the Novox Forex broker itself. The company that operates the broker has been fined several times and has connections with the brokerages that have been banned for various reasons. The features and the service of the broker do not look good either and at many occasions, the broker provides false information about the service. I think it is already enough reason to safely declare Novox FX scam real.

Comments (0 comment(s))