Tickmill Review – Premium Trading Conditions

The previous year, 2020 has been a tough period for financial markets. Partially, because of the extreme volatility of the markets caused by increasing speculations due to pandemics. However, some of the institutions and companies from the financial industry still managed to surprise the global community with unprecedented performances and made their name through successful operations. One of such companies is the brokerage firm Tickmill. The firm managed to break the record and hit over 115 million trades in 2020 and the trading volume of 195.6 billion US dollars only in March 2020.

Tickmill is a multi-regulated Forex and CFD broker with numerous awards offering premium products and services. The company has a reputation for providing industry-leading trading conditions. It is regulated within the United Kingdom, Malaysia, South Africa, Seychelles, and Cyprus. The brokerage firm is aggressively expanding and empowering traders all over the world to access new opportunities in various financial markets. The business model of Tickmill is concentrated around the trader’s needs in the most efficient manner. With over 80 trading instruments to offer, three main account types, two innovative trading platform options, and convenient trading conditions, Tickmill is definitely gaining a reputation as one of the best Forex brokers worldwide.

Tickmill Forex broker has around 350,000 live trading accounts registered on its trading platform. It employs over 200 full-time staff all over the globe and serves its clients in around 14 different languages. The order execution speed at the Tickmill trading platform is one of the fastest on the market. On average, the execution takes less than 0.20 seconds to be processed. Furthermore, the broker allows all the trading strategies that the traders might employ, including EAs, scalping, and hedging. Additionally, the broker implemented extra security measures to guarantee the safety and security of both client data and client’s funds with the broker. The review of Tickmill Forex broker will examine various features of the broker and will demonstrate the analysis of them in-depth.

Quick Overview of Tickmill

Tickmill Ltd is operated and owned by Tickmill Group which unites multiple brands of brokerage firms. The company was established in 2014 and since then has been providing premium services to over 150,000 traders worldwide. In appreciation of the high-quality brokerage services that the company offers, multiple honorary titles were awarded to the broker granted by various notable institutions.

Only recently, in 2021, the company received an award as a #1 Broker for Commissions and Fees by ForexBrokers.com Annual Forex Broker Review. In 2020, Tickmill earned 5 awards as the Best Commodities Broker (by Rankia Markets Experience Expo), Best Trading Experience (Forex Brokers Award 2020), Most Reliable Broker (Online Personal Wealth Awards), Best Forex Education Provider (Global Brands Magazine), and Best Trading Conditions (Shares Awards).

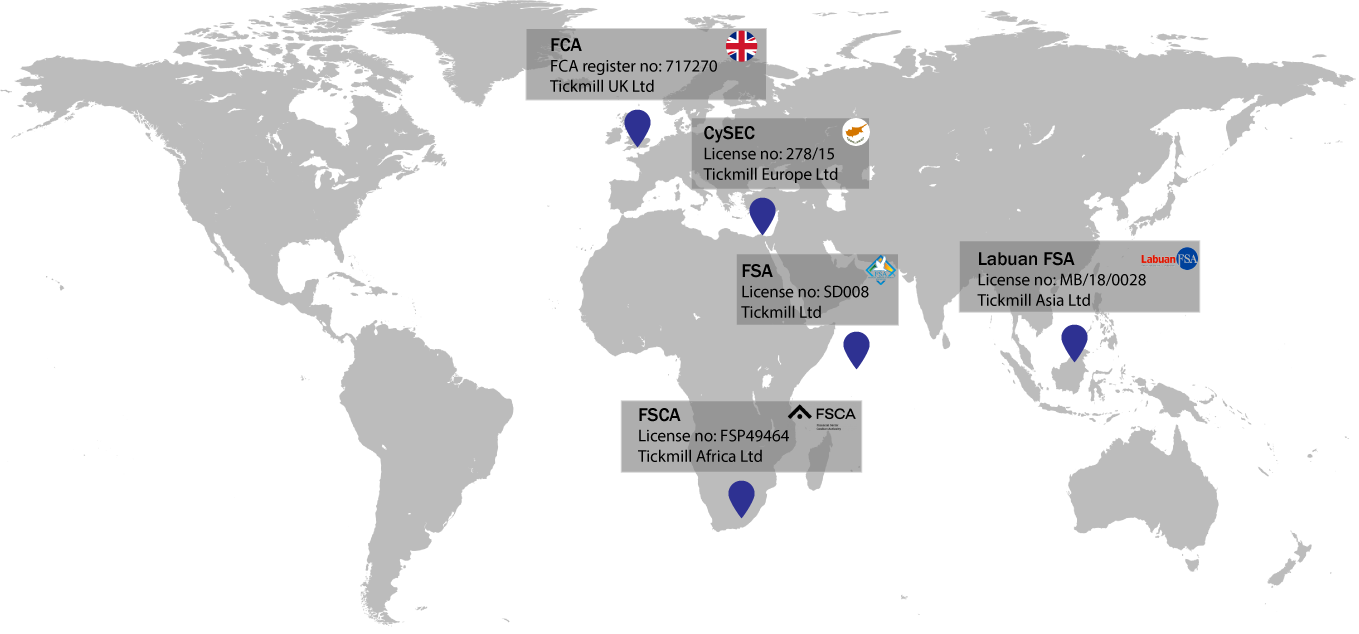

Regulatory framework of Tickmill

Tickmill Group owns licenses from five different regulatory bodies worldwide making each of its brand companies regulated and licensed by some of the most trusted authorities globally. Tickmill LTD is regulated as a Securities Dealer by the Seychelles Financial Services Authority (FSA). The license number of Tickmill LTD at FSA is SD008. Tickmill UK Ltd is authorized and regulated by the Financial Conduct Authority in the United Kingdom (FCA). The Financial Conduct Authority Register Number of Tickmill UK Ltd is 717270.

Tickmill Europe Ltd is regulated and authorized as CIF limited company by the Cyprus Securities and Exchange Commission (CySEC). The license number of the company with CySEC is 278/15. Additionally, Tickmill Asia Ltd holds the authorization and license from the Labuan Financial Services Authority (Labuan FSA). The corresponding authorization or license number is MB/18/0028. Finally, Tickmill South Africa (Pty) Ltd holds the license under the regulations of the Financial Sector Conduct Authority of South Africa (FSCA). The license number of the Tickmill Forex broker in South Africa is FSP 49464.

Trading assets at Tickmill

Despite the fact that Tickmill is considered to be the Forex broker, the company provides a diverse portfolio of trading assets. The instruments’ list available for the traders of Tickmill includes Forex, Stock Indices, and Oil, Precious Metals and Bonds. Each of these assets comes with the corresponding trading condition, leverage, spreads, swaps, and margins, as well as commission fees. However, most of the conditions are determined by the live trading account type that the customer holds with the broker.

Forex

Tickmill offers some of the best Forex pairs to trade on the platform of the broker. There are more than 60 currency pairs available within the Forex portfolio. The conditions set by Tickmill for trading on the Forex market are quite convenient and beneficial for most of the types of traders. The spreads start from 0.0 pips on Forex products and the average execution speed of the orders is 0.20 seconds. The leverage with Forex assets can go up to 1:500.

Stock Indices and oil

Stocks are popular trading instruments currently, however, some of the traders will always prefer to speculate on prices of the group of stocks rather than individual ones. There are some of the most popular stock indices available with the Tickmill brokerage firm. The traders can choose among over 15 stock indices available including AUS200, JP225, STOXX50, UK100, US500, and many more. The spreads applicable on indices assets are considerably low with the maximum leverage of 1:100. The average execution speed of the orders is 0.20s and there are no restrictions to trading strategies.

Precious Metals

Precious metals are considered as safe-haven assets every time something goes wrong in the financial industries. During the political and economic turmoil, people rush to invest in the metals like gold, for example, retains its value during the economic unrest, while stocks and currencies are highly vulnerable to significant fluctuations and losses. Tickmill Forex broker offers Gold and Silver crosses available to trade. The spreads start from 0.0 pip and the leverage on the Precious Metal assets goes up to 1:500. All trading strategies are allowed with the precious metals with an average execution speed of 0.20 seconds.

Bonds

Bonds are one of the most popular financial instruments traded worldwide at the moment. Also known as treasuries or securities, bonds have no central exchange for buying and selling them. The market is “over-the-counter”. Contrary to what many people believe, the bond market is much larger than the stock market. Tickmill provides four different bonds for its traders. The list of the assets includes EURBOBL, EURBUND, EURBUXL and EURSCHA. The spreads on bonds begin at 0.0 pip. The leverage can go up to 1:100.

Trading Platforms of Tickmill

Trading platforms, their accessibility, and simplicity to use play a crucial role in the decision of the traders to choose the broker. Almost all of the Top 10 Forex brokers in the world would offer the same software for trading, such as MetaTrader 4 and MetaTrader 5. However, the difference lies in the trading platform that integrated that software. The software itself requires downloading and installing. However, there are some of the versions like web trading platforms that offer inbuilt MT4 or MT5 available from browsers.

Tickmill provides MetaTrader 4 software for its clients, which is considered the number one favorite software for Forex traders, as it was specifically built to suit the needs and requirements of the traders. In addition to the downloadable software, recognizing the necessity of user-friendliness, the broker provides WebTrader. The WebTtrader implements the original MetaTrader 4 with all the features of the best Forex trading platform but is instead available from any browser. WebTrader needs no downloading or installation and gives the traders opportunity to trade on the go. All the security measures on client data, personal information and account balance are highly protected and safe on the platform.

Types of Tickmill Accounts

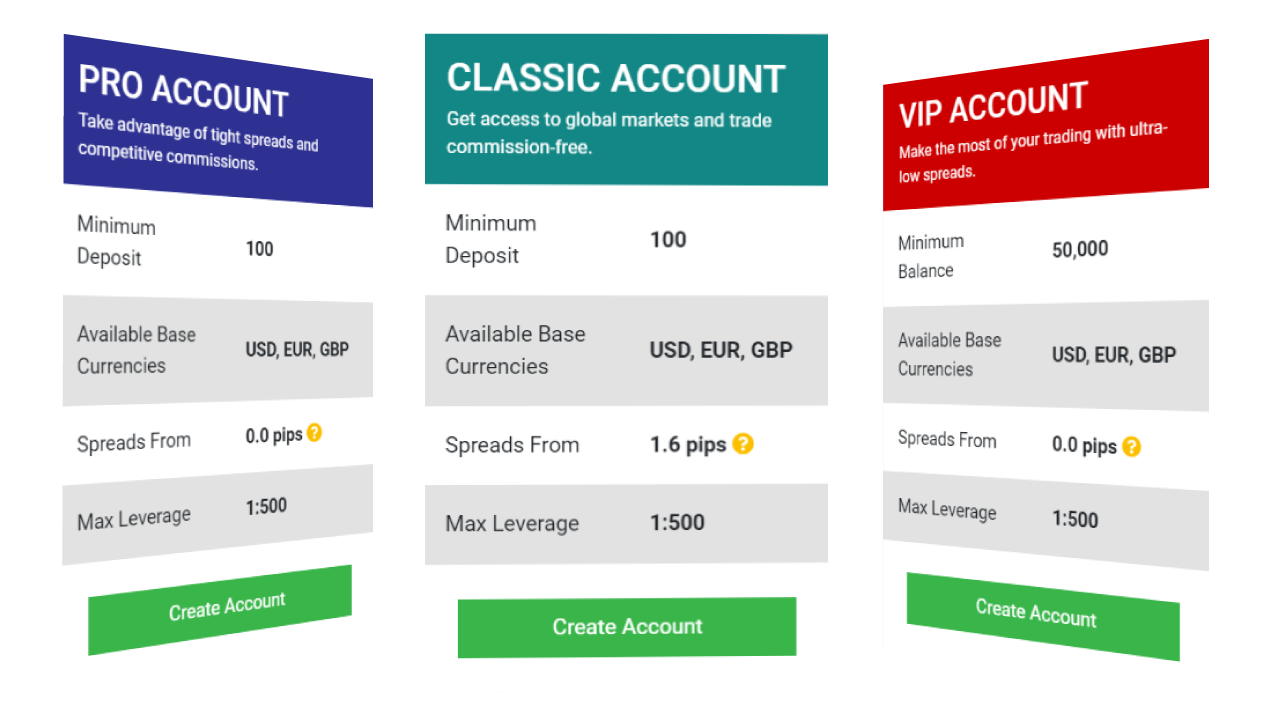

Tickmill opinion on the essence of the variety of the trading account matches ours. It is important to design several types of trading accounts that will differ in order to suit the needs, requirements, and demands of various trading styles and strategies. For that purpose, Tickmill provides three different account types with corresponding benefits that they offer to the traders. The account types are Classic, Pro, and VIP accounts. Additionally, clients can choose to set up an Islamic account on any of the mentioned account types.

Classic Account

The minimum deposit requirement for Classic Account holders is 100 US dollars or equivalent in other base currencies. The available base currencies for the given account type are USD, EUR, and GBP. The spreads start from 1.6 pips for the classic account holders. The maximum available leverage can go up to 1:500 varying according to the trading assets of the broker. The minimum lot is 0.01 and there are no commissions applicable to this account type. All strategies are allowed, including EAs, scalping, and hedging and clients can choose to implement the Swap-free Islamic account option.

Pro Account

The minimum deposit requirement for the Pro account is 100 US dollars or equivalent in EUR and GBP, again. The available are currencies are the same, USD, EUR, and GBP. The spreads, however, start from 0.0 pips for the Pro account holders. They can also enjoy the maximum leverage of up to 1:500. The minimum lot size is 0.01. On the other hand, commissions are applicable to Pro account types. The commission fee is 2 per side per 100,000 traded. Furthermore, there are no limitations to which trading strategy can be applied by the traders. The swap-free Islamic Account option is also available on Pro Account.

VIP Account

VIP account is a premium account for intermediate and experienced traders or novices who are confident in their decision to start trading. There is no minimum deposit requirement for the account type, however, the minimum balance requirement for VIP account holders is 50,000 USD or equivalent in EUR and GBP. The spreads on VIP account start from 0.0 pips. The minimum lot size is the same for this account type – 0.01. However, the commission fees are much lower than for Pro account holders. The commission fee is 1 per side per 100,000 traded. Again, any trading strategy could be used with VIP account, including EAs, Scalping, and Hedging. The option for the swap-free Islamic Account is available for VIP account holders, too.

Promotions and Rewards

Rewarding the customers is one of the best ways to retain their loyalty towards the company. The bonus schemes, promotional campaigns, and reward programs encourage the traders to keep cooperating with the company and at the same time give them additional capital to enhance their financial resources. European regulated Forex broker Tickmill provides multiple programs to reward its clients that include both trading contests that are based on the individual performance of the traders and the bonus schemes, such as welcome bonus.

Contests

Tickmill holds two separate contests for its customers on a regular basis. The first contest is a Trade of the Month contest. The purpose of the contest is to reward the remarkable achievements of the traders. Accordingly, every month, the broker will choose the most skilled trader and award him or her a 1,000 US dollar cash prize.

The winner is announced according to the results, total profit generated, total deposits made, and risk management skills. There is no separate registration required in order to participate in the tournament. Registering and opening a live account with Tickmill automatically involves the participant in the contest.

The second contest is called the Global IB Championship. It is an annual contest for the Introducing Brokers in Asia, MENA, Latin America, and other regions. The points are accumulated base on the participants’ clients’ trading volume. In order to qualify, customers of the brokerage firm will need to start introducing new traders to Tickmill and keep them engaged. The more the new clients trade more points participants collect. The contest runs from 15h February 2021 until the 15th June of 2021.

Bonuses

The bonuses are another way to win the loyalty of the customers. The Tickmill rating is strongly determined by its generous reward programs including the bonus schemes. The broker offers no deposit bonus for the new registering clients. The amount of the no deposit bonus is 30 US dollars. The users can claim the bonus when registering the real trading account with Tickmill. Any profits generated from the bonus can be claimed after meeting the trading volume requirements.

The bonuses are another way to win the loyalty of the customers. The Tickmill rating is strongly determined by its generous reward programs including the bonus schemes. The broker offers no deposit bonus for the new registering clients. The amount of the no deposit bonus is 30 US dollars. The users can claim the bonus when registering the real trading account with Tickmill. Any profits generated from the bonus can be claimed after meeting the trading volume requirements.

Another promotional campaign run by the broker is Tickmill’s NFP Machine campaign. The program targets to test the intuition of the traders and reward them for every correct guess. The program runs on a weekly basis. At the beginning of the NFP week, Trickmill will choose one instrument and will challenge the traders to guess its price on the MT4 trading platform at 16:00, 30 minutes after the NFP release. The participant who guesses the exact price will be awarded 500 US dollars, which will be credited to his or her trading account. If no one guesses the exact price amount, then the participant with the closest figure will claim 200 US dollars cash prize.

Tickmill Website and Support Team

The website of the brokerage firm Tickmill is one of the user-friendly websites that the broker might develop. The interface is based on simple logic and all the information is easily accessible and trackable on the website. The website has a dedicated webpage to all the important content, including the one where the users can find legal documentation, information on regulations and licenses, company background, support team, and contact information. The website also has different sections, such as Trading, that includes all the instruments, trading account types, and trading conditions; Platforms, with the detailed information on MetaTrader 4 and WebTrader; Client Tools, where various tools are demonstrated and explained along with the educational material provided by the broker and Promotions, where you can find all the news and information on current promotional campaigns offered by Tickmill.

The customer support team is available from 7:00 to 16:00 GMT from Monday to Friday. The traders can either call the support team through the direct phone line, leave a message directly from the website within the special message form or send an email to the designated department. The customer support team operates in more than 10 different languages in order to suit the needs of their clients from various backgrounds.

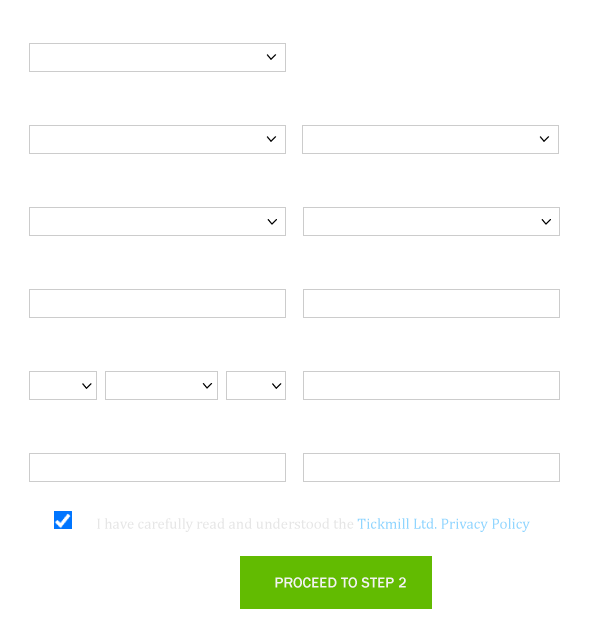

How to start Forex trading at Tickmill

Registration procedure with the broker is relatively easy. It consists of two simple steps. In the first stage, clients need to fill in the basic personal information. It includes the country of the residence, preferred communication language, first and last names, trading instruments of choice, date of birth, phone number, and email address. It is very important to correctly input the data into the form as the details will be double-checked at later stages to go through the verification process.

After proceeding to step 2, the broker will require additional data on clients. The users have to input their residential address, Tax Identification Number (TIN) (if any), nationality, level of education and the status of employment, financial backgrounds, such as the source of funding, gross annual income, trading objectives, and total net worth. Also, users will need to fill in the trading experience and create a password. After completing step 2 clients are official registered on the platform of Tickmill Forex broker. Later, they can choose the account type, make an initial deposit or go through the verification procedures.

Deposits and Withdrawals

One of the key components of enhancing the trading experience is the ability to deposit and withdraw money from multiple payment solution providers. During our Review of the Tickmill Forex broker website, we noticed that the broker provides more than 10 different payment solutions for its traders. Furthermore, the firm covers any deposit costs associated with deposits of over 5,000 USD or equivalent in other currencies made by bank wire transfer. The Zero fees policy covers transaction fees up to 100 USD or equivalent in other base currencies. The traders only need to present a copy of the bank statement or any other confirmation document for the transfer.

The company offers all the popular payment methods including wire bank transfer, Visa and Mastercard payments, Skrill, Neteller, FasaPay, NganLuong.vn, SticPay, UnionPay, QIWI, and WebMoney.

Education material of Tickmill

Tickmill has one of the most extensive educational resources available for traders of all backgrounds. The list of the educational materials’ portfolio includes various webinars, seminars, infographics, eBooks, video tutorials, glossaries, market and financial analysis, articles and so much more. The webinars cover all the important topics of the different financial markets and are held on a daily basis. The webinars present some of the most notable speakers and experts in the field and are covered in many different languages. The global seminars occur almost every month and the traders of Tickmill have an opportunity to attend the global summits free of charge.

Tickmill has one of the most extensive educational resources available for traders of all backgrounds. The list of the educational materials’ portfolio includes various webinars, seminars, infographics, eBooks, video tutorials, glossaries, market and financial analysis, articles and so much more. The webinars cover all the important topics of the different financial markets and are held on a daily basis. The webinars present some of the most notable speakers and experts in the field and are covered in many different languages. The global seminars occur almost every month and the traders of Tickmill have an opportunity to attend the global summits free of charge.

Furthermore, the market and financial analysis are written by professional industry leaders and are updated on a regular basis. The infographics also cover some of the most notorious events of financial history, concepts, and many sectors and markets. The tutorials are designed both for newcomers in trading and experienced traders. The videos describe different markets, such as Forex and applicable concepts. There are introductory and intermediate tutorials available, as well. The topics of the video tutorials include Forex trading, market analysis, trading psychology, trading strategies, social trading, stocks, MetaTrader 4, CFDs, Managed accounts, Technical indicators, and many more.

Tickmill Review – Key Takeaways

Tickmill is a multi-regulated Forex broker that is a leading brokerage services provider in the industry. The broker has won numerous awards as the best provider of the trading instruments, one of the top trading conditions, advanced and user-friendly trading platforms, exceptional promotional programs, and multiplicity of the available payment methods. From our review of the broker, it is evident that the Forex broker is indeed one of the most customer-centric brokerage firms that put extra effort in developing the competitive trading environment and establishing the best trading experience for the clients.

The accessibility to various platforms, educational resources, multiple account types, and freedom to choose any trading strategy including EAs, scalping, and hedging makes the broker a truly attractive option for traders of all backgrounds. Furthermore, the flexible leverage and one of the tightest spreads on the market give us the confidence to state that Tickmill Forex broker is indeed a strongly recommended broker for our readers.

Comments (0 comment(s))