Reviewing TradeATF – What does this broker offer?

TradeATF is a famous Forex broker offering services throughout Europe and several other jurisdictions. The broker was established a few years ago and it is a fairly new company. Over the last few years, it has managed to become one of the best-known brokers among traders.

Although it has a fairly short history, it was still able to attract as many as 10,000 active users. There are many things that traders like about this Forex broker, including different types of trading accounts, access to more than 350 trading assets, and very fast execution.

Because of the competitive services offered to traders, TradeATF is constantly developing and becoming more popular. We have decided to take a greater look at the offerings of this broker. Follow our review of TradeATF and learn what it is that makes this broker stand out in this very competitive market.

Reviewing TradeATF – How does this broker work?

TradeATF is a perfect example of the fact that brokers do not need years of experience to offer great services. To create this broker, well-experienced and professional traders came together and ended up offering traders what is needed very much in this market – safety and security.

The team behind the broker is full of professionals, which is a necessity to create a successful Forex broker. These are the people who know exactly what traders are looking for, thus, the services that this broker offers, are very much loved by traders of all backgrounds.

There are more than 350 available trading assets at TradeATF. Thanks to this, anyone can easily diversify their trading portfolios. The broker offers traders access to currency pairs, cryptocurrencies, commodities, metals, indices, and a number of other trading assets.

Regulatory framework of TradeATF

TradeATF notes that the safety and security of its clients is the absolute priority of its team. Because of this, the Forex broker follows a very strict regulatory framework. Among many other requirements and policies, the Forex broker keeps the funds of the clients on segregated bank accounts.

The segregation of clients’ money is a very important step towards safety. This way, no matter what goes wrong, traders can be sure that their funds are kept safe. According to our review of TradeATF, this broker has partnered with leading banks to make sure that your money is kept safe.

Even if the Forex broker goes bankrupt and leaves the market, traders can be sure that their funds are kept safe on their dedicated bank accounts. Another policy of the broker is the Negative Balance Protection. This means that the broker makes sure that you are not losing more money than you can afford.

While trading with higher leverage, traders might find it hard to control the amount of money that they are spending. There have been several cases where people ended up losing more money than they had on their trading account. With the negative balance protection, your account will not be able to get into the negative side.

This means that when your account balance nears zero, all of your positions will be closed automatically. Thus, you will not be able to lose more money than you can afford.

TradeATF review – Who regulates it?

TradeATF is licensed by the International Financial Services Commission, simply known as IFSC. It is a government agency from Belize, which is responsible for financial regulation. It regulates all of the financial market participants, which includes exchanges, financial companies, and online Forex brokers. There are hundreds of companies that follow the regulatory framework of this agency.

Thanks to the regulations and rules of the IFSC, TradeATF makes sure that all of its client’s funds are kept safe at all times. The Forex broker also follows the Know Your Customer policy, which means that it is working very hard to fight against money laundering.

Because the broker follows KYC policy, you might have to provide different types of documentation to the broker to create a live account. These documents are needed to prove your identity.

Reviewing TradeATF broker – Trading assets

There are hundreds of different assets available in this market, but not all brokers offer access to them. For many traders, it is very important to use a broker that is willing to offer different types of assets so that they can easily diversify their trading portfolio.

As we have already said previously, there are more than 350 trading assets available for traders at TradeATF. This includes:

- Currency Pairs

- Cryptocurrencies

- Indices

- Stocks

- Commodities

- Metals

Forex trading is the biggest market globally. It should not come as a surprise that this broke largely focuses on currency trading. There are more than 45 currency pairs available at TradeATF, this includes all types of currencies, such as Major currency pairs, Minor currency pairs, and Exotic currency pairs.

Forex trading market is accessible 24 hours a day for traders 5 days a week. Thanks to the services of this Forex broker, you can easily get access to the currency pairs. It can be traded any time of the day using some of the best trading platforms globally. You can also use different types of tools to make this job much easier.

Offerings of TradeATF reviewed

As we have already said, currency pairs are not the only thing that this broker offers to traders. There is a number of other trading assets available for TradeATF clients. As our review of TradeATF showed, the broker offers people more than 30 cryptocurrencies, including Litecoin, Bitcoin, and Ethereum among others. You can also trade stocks of leading companies such as Apple, Microsoft, and Netflix.

Investors can also trade commodities at TradeATF. Commodities have always been very popular among traders globally. There are two types of commodities available at TradeATF, which are hard and soft commodities. Soft commodities are the ones that are a result of agricultural activity, while hard commodities are the ones such as gold and silver. You can also trade energies, such as crude oil, with this broker.

There also are 15 indices available at TradeATF. All of these are possible through CFD trading. CFDs give traders the opportunity to trade assets without actually having to own them. This can be done by speculating on the future price changes of the assets. This way, traders can make a profit during an uptrend as well as during the downtrend.

Reviewing TradeAFT – Trading accounts

Most of the Forex brokers online offer different types of accounts to traders to make sure that they can find something that they enjoy. This broker is not an exception either. It offers three main account types and another two special accounts. If you are a complete beginner in Fore trading, TradeAFT can give you access to its deme trading account.

A demo account is one of the best ways to start Forex trading. By using this account, you will be able to learn more about Forex trading, test out different types of strategies, and grow as a trader in general. Many people have this misconception about demo trading accounts that it is something for only beginner traders, however, it can be very beneficial for experienced traders as well.

With a demo account, you are essentially getting a certain amount of virtual cash from the broker, which you can use for trading. Although you can’t generate any profits from this account, you can learn a lot about the actual trading experience. For experienced traders, it can be a way to focus on trading skills and come up with different types of strategies and see which ones work better for them.

Three major types of accounts of TradeAFT reviewed

As we have already said, TradeAFT offers three major types of accounts. They are:

- Silver Account

- Gold Account

- Platinum Account

According to your experience and needs in Forex trading, you can choose either of these account types. Silver account is a perfect choice for those who are newer to the trading market. It offers lower leverage of 1:30, which is a reasonable choice if you are new to the trading market.

This account was created to serve the best interest of beginners in Forex. It has very attractive trading conditions offered to newcomers in the market, including dedicated support help at all times. Traders will have access to all available trading assets with the Silver account type. The spreads a little higher, but they are still very competitive, starting at only 0.7.

As for the Gold Account, TradeAFT says that it will let traders ‘go further’ in their journey to Forex trading. If you are someone who is already comfortable with the market and is up-to-date with the changes happening here, Gold Account will be a perfect way for you to conquer new challenges.

Thanks to the dedicated account manager and a huge educational hub, this account type will be very beneficial for traders who want to upgrade the benefits and their profits. The spreads for this account type starts from 0.05, and the leverage is up to 1:400. Traders get a swap discount of about 20%, while also having access to hedging and different types of trading signals.

If you are already very comfortable with trading, you can go with the platinum account, which is intended for professional Forex traders. It is an amazing offering for those who have advanced knowledge and experience in the Forex trading market. This will help you further diversify your trading portfolio by trading hundreds of different trading assets. The spreads are also very low with this account, starting at just 0.03. As for the leverage, it can go up to 1:500 for professional traders. The swap discounts that traders can get with this account are up to 50%.

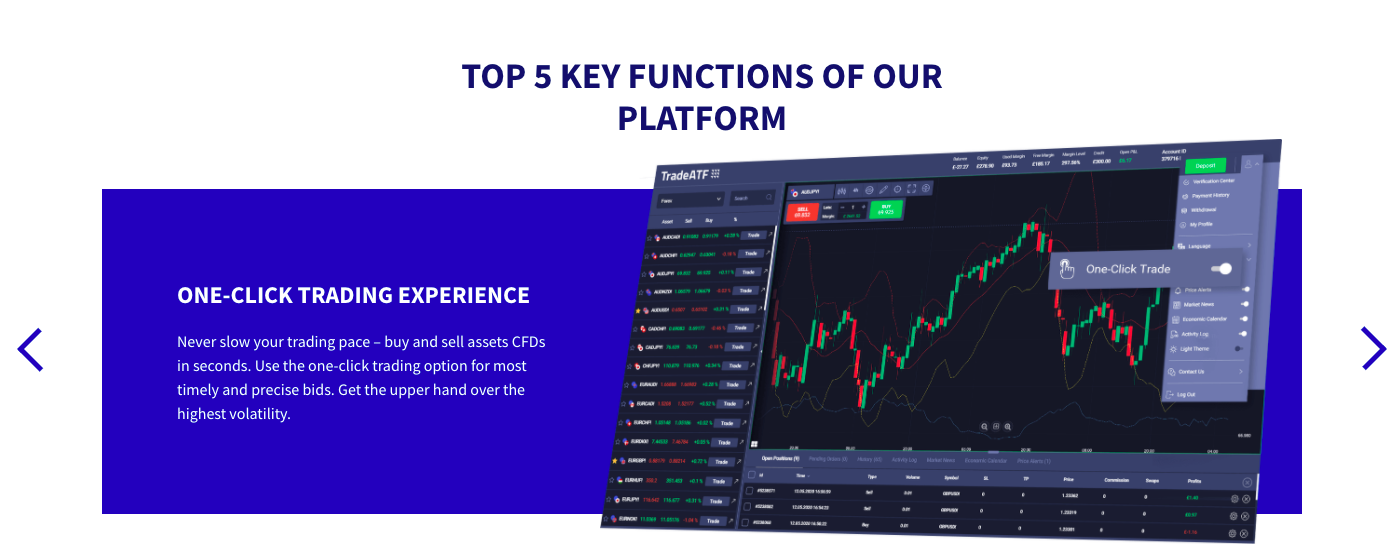

Trading platforms of TradeAFT review

Trading platforms are probably one of the most important parts of Forex trading. It is something that gives you access to the Forex trading market, thus, it is very important to use the best one. You will be spending most of your time using the trading platform.

This will be a place where you will initiate the actual trading, it can also be used for charting and analytical purposes. This Forex broker offers a very famous trading platform, known as the MetaTrader 4. It was created by a famous Russian company, MetaQuotes 16 years ago.

Ever since then, MetaTrader 4 has changed the way people trade Forex forever. In fact, MT4 is used by more than 90 percent of all Forex brokers online. Thanks to MetaTrader 4, TradeAFT is able to offer traders access to dozens of trading indicators and tools which can be very helpful for traders.

The website of the broker and the customer support team

While reviewing TradeAFT broker, we decided to focus on the details. As we were able to find, the website of the Forex broker looks very good. The information there is shown in a very detailed and logical way. It looks very modern and you can find any type of information that you might be looking for very easily.

There also is a huge amount of educational material on the website of the Forex broker. This is a very important thing. Most of the Forex regulatory agencies require brokers to offer traders high-level educational material. The one found at TradeAFT is actually very informative and can be very helpful for traders.

As for customer support, there are several ways to contact them. You can use live chat, email, or call them directly. We have tried all three of these options and found that they are very helpful. The live chat is very fast, they got back to us in no time. The same goes for the phone.

Although the mail solution took a long time, we were able to get very detailed information through this channel.

Should you trust a TradeAFT broker?

Yes, we recommend our readers to use this broker. TradeAFT provides traders with high-level services, with exceptional execution and unmatchable services. The Forex broker focuses a lot on the safety of traders and the experience they have.

There are more than 350 trading assets available for traders at TradeAFT, three different types of accounts, and many other things. The Forex broker is able to offer traders the safety and security that is needed in this market so much. Because of this and many other reasons, we recommend this Forex broker to our readers.

Comments (0 comment(s))