How to open a Forex trading account in South Africa?

Catalogue

To start trading Forex in South Africa you need to register a live trading Forex account. Without a trading account, the only option you have is to walk through the physical currency exchange stores and exchange your money there. But it means that you lose an enormous amount of time, as well as money. The physical exchanges are incredibly slow in updating the Forex exchange rates and are charging more for the exchange, which otherwise would cost you four times less with a broker with low spreads. Hence, first thing is to find the broker and register a real trading account.

But, the question is, how do you know which Forex trading account is best for you? We are not talking about account types here, but the brokerage companies. Because choosing a Forex account type is a different topic which you have to consider separately. In this article, we will be advising the best Forex brokers for beginners to open an account with and will guide you through the process of creating and activating your very first trading account.

Best Forex trading accounts in South Africa

Before we dwell on the specifications of Forex trading accounts and registration processes, we will provide a complete list of the best brokerage companies where you can open a Forex real account in South Africa. We have chosen these brokers according to their regulatory framework (all of them are licensed), their experience on market (all of them have been working for 5+ years), the diversity of the financial instruments portfolio (these brokers have 800+ trading assets), available trading platforms (MT4, MT5, cTrader, proprietary platforms) and overall feedback from the existing customers (surprisingly positive feedback). We will cover the best 3 brokers from the list in greater detail within the following paragraphs, so do not worry about choosing one right this moment.

AvaTrade

Starting Capital

$100

Financial License

FSA, FFAJ, CySEC, CBI, BVI FSC, FSCA, FSRA

Promotion

Financial Leverage

1:400

Established

2006

Trading Software

MT4, MT5, WebTrader, AvaTradeGO

XM

Starting Capital

$5

Financial License

CySEC, FCA, ASIC

Promotion

$30, 50%+20%

Financial Leverage

1:1000

Established

2009

Trading Software

MT4, MT5, WebTrader

Plus500

Starting Capital

ZAR 1,500

Financial License

FCA, CySEC, ASIC, FSCA, FMA

Promotion

25%

Financial Leverage

1:300

Established

2008

Trading Software

MT4

RoboForex

Starting Capital

€/$ 10

Financial License

FSC

Promotion

30%

Financial Leverage

1:2000

Established

2009

Trading Software

MT4, MT5

CM Trading

Starting Capital

250$

Financial License

FSCA

Promotion

Financial Leverage

1:200

Established

2012

Trading Software

MT4, Sirix WebTrader, Copykat

Exness

Starting Capital

$10

Financial License

FCA, CySEC, FsA, FSCA

Promotion

10%

Financial Leverage

1:2000

Established

2008

Trading Software

MT4

IQ Options

Starting Capital

$10

Financial License

CySEC

Promotion

Not Available

Financial Leverage

1:30

Established

2013

Trading Software

WebTrader

EagleFX

Starting Capital

$10

Financial License

N/A

Promotion

N/A

Financial Leverage

1:500

Established

2019

Trading Software

MT4

OspreyFX

Starting Capital

$10

Financial License

N/A

Promotion

N/A

Financial Leverage

1:500

Established

2019

Trading Software

MT4

AMarkets

Starting Capital

$/€ 100

Financial License

FSA

Promotion

15%

Financial Leverage

1:1000

Established

2007

Trading Software

MT4

Forex.com

Starting Capital

$50

Financial License

FCA

Promotion

Not Available

Financial Leverage

1:200

Established

1999

Trading Software

MT4, WebTrader, custom

FXRoad

Starting Capital

250 EUR

Financial License

FSA, Seychelles

Promotion

None

Financial Leverage

1:200

Established

Unknown

Trading Software

FXRoad web and mobile platform

HotForex

Starting Capital

5 USD

Financial License

FCA, FSA, DFSA, FSCA

Promotion

100%, 30%, 100%

Financial Leverage

1:1000

Established

2010

Trading Software

MT4, MT5, WebTrader

ForexMart

Starting Capital

15 USD

Financial License

CySEC

Promotion

30%

Financial Leverage

1:500

Established

2015

Trading Software

MT4, WebTrader

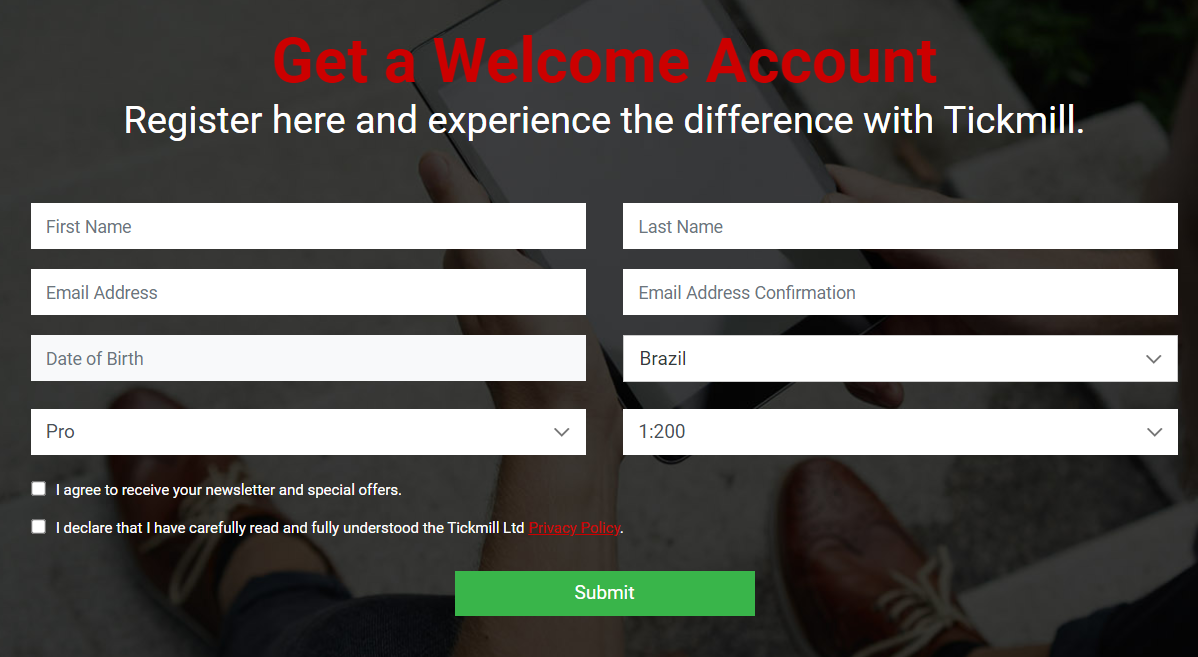

Tickmill

Starting Capital

100 USD

Financial License

FSA, FCA, CySEC, FSCA, FSALM

Promotion

30% Welcome Bonus

Financial Leverage

1:500

Established

2014

Trading Software

MT4, WebTrader

FXOpen

Starting Capital

1 USD

Financial License

ASIC, FCA

Promotion

10 USD

Financial Leverage

1:500

Established

2005

Trading Software

MT4, MT5, WebTrader, TickTrader

Things to consider before registering your account with the broker

First things first, make sure you are dealing with a regulated brokerage company. Do not forget about the significance of the legal framework and background, as it is the only thing that can save you from unnecessary trouble, like losing your money to scam companies and never being able to get it back. The regulators will guarantee that if anything goes wrong with your trading account they will investigate the case and will promise you a refund if you are legally entitled to receiving it. In the ideal scenario, your broker should be regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. This local financial authority will be your guardian angel if your broker is registered with the regulator.

First things first, make sure you are dealing with a regulated brokerage company. Do not forget about the significance of the legal framework and background, as it is the only thing that can save you from unnecessary trouble, like losing your money to scam companies and never being able to get it back. The regulators will guarantee that if anything goes wrong with your trading account they will investigate the case and will promise you a refund if you are legally entitled to receiving it. In the ideal scenario, your broker should be regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. This local financial authority will be your guardian angel if your broker is registered with the regulator.

Secondly, check the trading costs of your broker. There are many types of trading costs such as commissions, spreads, rollover fees (swaps), administrative costs, account maintenance costs, etc. Remember to look for the brokerage companies that allow you to trade with 0 commissions, at least on Standard trading account types. In the current world, the competition between the brokers is too high. Hence, a decent amount of them will not charge commissions for Forex trading, which means you have to look for them. Another thing is that you do not want a broker that has 3 pips spreads on EUR/USD currency pair, or 50 pip spread on USD/ZAR currency pair. Look for low-spread ZA brokers for sure.

Finally, make sure that your broker has a suitable live trading account for you. If the account asks for 150,000 ZAR initial deposit and spreads are inconvenient, there are no benefits and you have to trade with commissions, forget about the broker. Your standard account with the broker should allow you to start trading with a minimum deposit requirement that does not exceed 1,500 South African rands. In ideal scenarios, you have to deposit only 75 South African rands in order to activate your trading account. Furthermore, you should not be limited in the available tradable assets and the broker’s portfolio should offer at least 25 different currency pairs along with South African shares, commodities, indices, and maybe cryptos, as well.

Registering with XM

XM is a highly regulated Forex broker that also holds an authorization from the Financial Sector Conduct Authority (FSCA) in South Africa. No doubt, this broker is one of the favorite brokerage companies for South African traders. XM has a diverse portfolio with 1200+ trading asset classes and two of the most advanced Forex trading platforms supported on the website – MetaTrader 4 and MetaTrader 5. The broker also offers multiple promotional programs and campaigns that include a 30 USD no deposit bonus along with a 50%+20% deposit bonus for first-time clients from South Africa.

XM is a highly regulated Forex broker that also holds an authorization from the Financial Sector Conduct Authority (FSCA) in South Africa. No doubt, this broker is one of the favorite brokerage companies for South African traders. XM has a diverse portfolio with 1200+ trading asset classes and two of the most advanced Forex trading platforms supported on the website – MetaTrader 4 and MetaTrader 5. The broker also offers multiple promotional programs and campaigns that include a 30 USD no deposit bonus along with a 50%+20% deposit bonus for first-time clients from South Africa.

Before you register with XM you have to choose the trading account type – Micro, Standard, XM Ultra-low, or Shares account. The first three account types, micro, standard, and XM Ultra-low, require only 75 South African rands as an initial deposit. The Shares account is the most expensive one with the minimum deposit requirement exceeding 1,500,000 South African rands. The first three trading accounts also operate without any commission charges and offer spreads starting as low as 0.7 pips on the most popular Forex currency pair EUR/USD.

In order to register with XM, you have to be considered the legal age in your country of residence. The eligibility criteria do not filter out anyone after satisfying the first condition. The registration process with XM consists of two stages. At first, you have to provide personal details such as your name/surname, your legal address, your trading experience, and expertise and some other questions the broker might have. The second part is the legal aspect of trading Forex. You will have to upload the documents that prove your identity and residential address such as the scan of your Identification Document, Passport or Driver’s License, and the utility bills from the last 6 months.

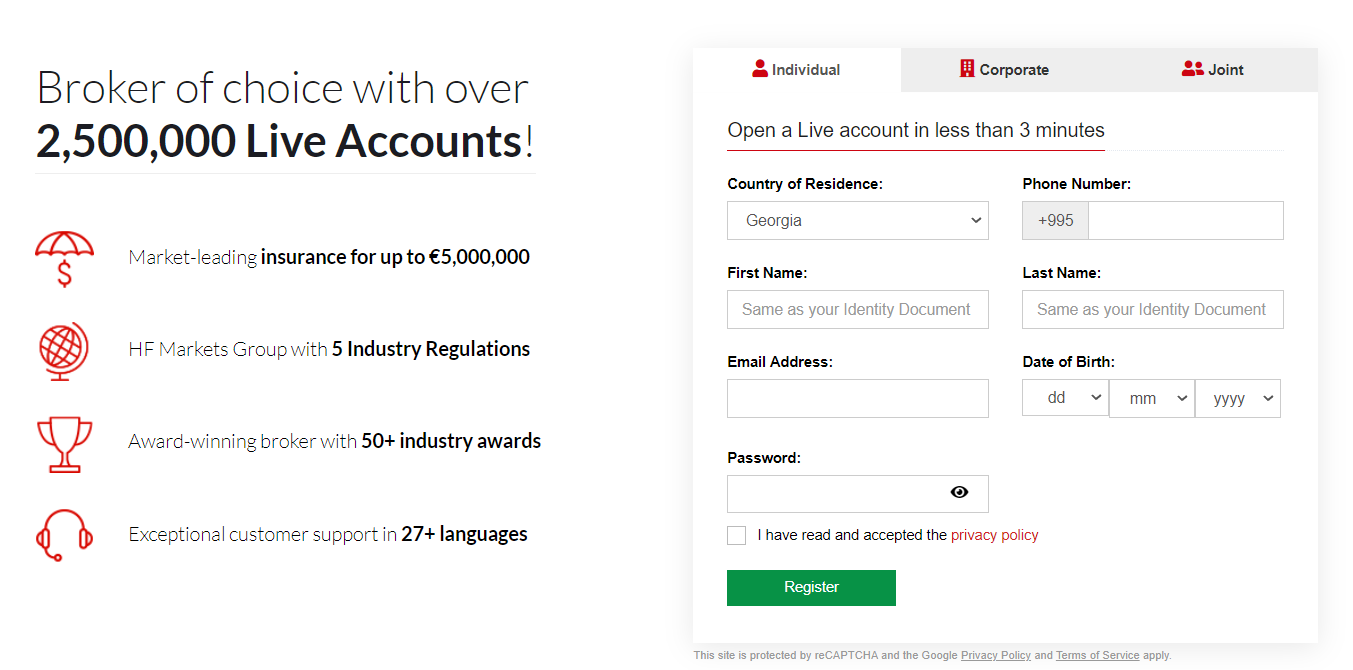

Registering with HotForex

HotForex is another multiregulated Forex broker with competitive trading conditions for South African traders. The broker supports more than a thousand trading-asset portfolios including stocks, energies, metals, over 60 currency pairs, indices, options, etc. HotForex has one of the most diverse classes of CFD financial instruments available for trade. The broker also supports the most popular Forex trading platforms of MetaTrader 4 and MetaTrader 5 along with copy trading opportunities with the top signals from the MQL5 database.

HotForex has more than 6 Forex trading account types that range from micro to Zero Spread trading account types. The Micro and Standard trading account types are commission-free and allow traders to start with 75 South African rands as an initial investment. However, the Zero Spread trading account type comes with a variable commission rate depending on the size and volume of the trade. The traders can also access the ZAR trading account, which allows them to choose the South African rand as their account base currency.

To register with HotForex, traders have to provide personal details (the same as with XM) and also complete the questionnaires regarding their expertise and knowledge in Forex trading. The broker might also require information regarding your trading goals and whether you plan to use a copy trading platform, or not. You will also have to upload the supporting documents that serve as proof of your identity and residential address. After registration, you will be eligible to claim a few of the many promotional campaigns offered by HotForex including the 100% supercharged bonus, 30% rescue bonus, 100% credit bonus, and various performance-based trading contests.

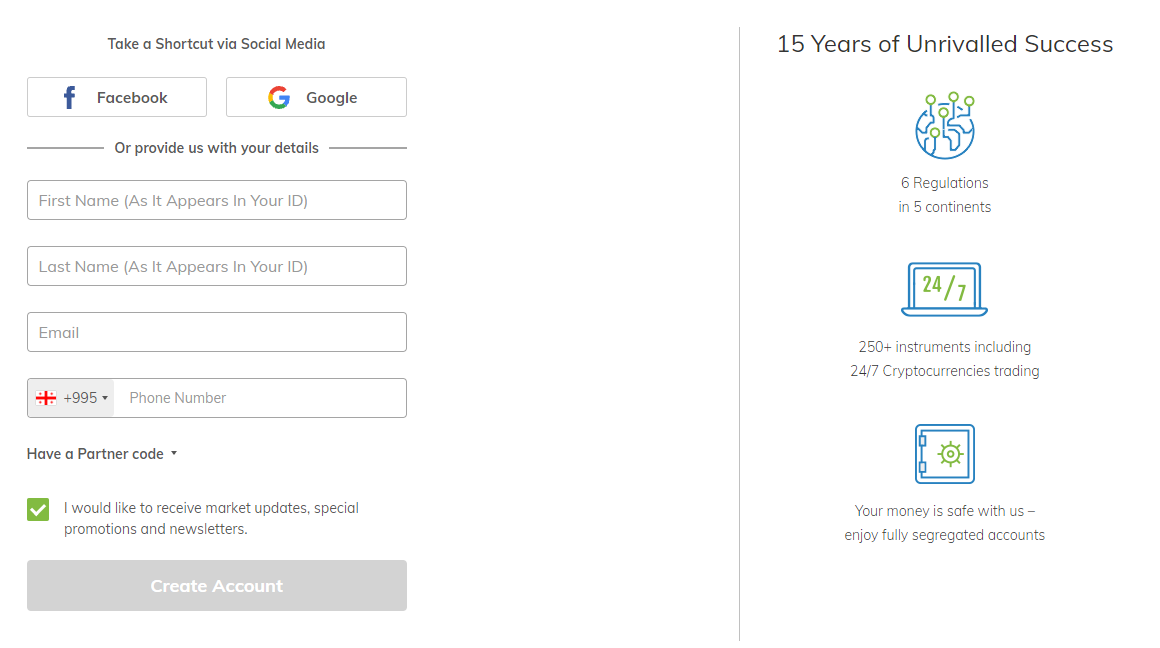

Registering with AvaTrade

AvaTrade is considered to be the safest Forex broker in South Africa for multiple reasons. First of all, the broker is authorized and licensed by 8 different financial authorities all over the globe. The broker holds a license from the Dubai Financial Services Authority (DFSA), the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchanges Commission (CySEC), the Australia Securities Investment Commission (ASIC), the Financial Services Agency of Japan (FSA), the Financial Sector Conduct Authority (FSCA) in South Africa and more.

AvaTrade is considered to be the safest Forex broker in South Africa for multiple reasons. First of all, the broker is authorized and licensed by 8 different financial authorities all over the globe. The broker holds a license from the Dubai Financial Services Authority (DFSA), the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchanges Commission (CySEC), the Australia Securities Investment Commission (ASIC), the Financial Services Agency of Japan (FSA), the Financial Sector Conduct Authority (FSCA) in South Africa and more.

AvaTrade also is one of the most diverse brokers in terms of available Forex trading apps and platforms. You can choose either traditional trading software such as MetaTrader 4 and MetaTrader 5 or go with the groundbreaking and innovative automated trading tools such as ZuluTrade and DupliTrade. Furthermore, the broker also developed its own proprietary trading platforms such as AvaTrade GO, compatible with nearly every mobile device existing out there, and AvaSocial, one of the leading social trading platforms currently in use on the market.

Registering with AvaTrade is surprisingly easy. One of the reasons for that is that the broker has only a single trading account type – Standard. If you want to upgrade to the professional trading account you will have to provide the proof documents that you are an experienced trader with an expertise of more than 6-24 months trading with securities and you will have to show your performance, as well, even if it is recorded with another broker. Furthermore, you would have to provide that you have more than 500,000 US dollars available in equity at the moment. However, registration for the AvaTrade Standard account is exactly the same as for HotForex and XM brokers.

What do you need for opening a Forex real account?

There are few things that you require for registering your first real trading account in the Forex industry. But the primary aspect is choosing your broker. We will chronologically list the steps that you need to take before opening your very first trading account and we will cover each step in greater detail below.

There are few things that you require for registering your first real trading account in the Forex industry. But the primary aspect is choosing your broker. We will chronologically list the steps that you need to take before opening your very first trading account and we will cover each step in greater detail below.

- Do research on Forex brokers

- Develop your trader’s profile

- Choose the best broker for you

- Choose your trading assets and strategy

- Choose your trading account type

- Test the broker and account on a Demo account

- Make the deposit

- Start trading

We have already covered some aspects of the research that you have to conduct before registering with the Forex broker in South Africa. We highlighted the importance of finding a broker with official licenses and regulations. However, one more thing that you need to consider is the reputation of the broker. Even if the broker is regulated and licensed and offers thousands of trading assets, you may still not be satisfied with the brokerage services. So, don’t forget to read the individual reviews of the brokers written by either experts in the industry or the traders themselves.

Think about what kind of a trader you are. Assess your risk tolerance or how much of the losses you can actually absorb. Decide what is your budget and how much are you willing to invest in trading. Do not forget to think about your trading schedule, as well. Are you able to become a full-time trader? or can you spend around 4 hours a day in front of a screen? or are you looking for ways to reduce your screen time and pay attention to your trades once per few days? All of these aspects will help you decide your trading style and strategy, which you require before you choose between the trading accounts and the brokers

Choose the broker that suits your needs – that offers trading account types matching with your trading style. If you are a complete beginner, it is best to choose the broker with extensive educational programs or free educational resources to help you guide through the first steps in Forex trading. You can always schedule a call with your broker and ask the questions that you find interesting. They might also help you in choosing the best Forex trading account type for you.

Choose the broker that suits your needs – that offers trading account types matching with your trading style. If you are a complete beginner, it is best to choose the broker with extensive educational programs or free educational resources to help you guide through the first steps in Forex trading. You can always schedule a call with your broker and ask the questions that you find interesting. They might also help you in choosing the best Forex trading account type for you.

The best way to test if your strategy is working, if your broker’s services are suitable and if your skills are enough to drive you a certain income in Forex trading is to open a Demo trading account. The Demo account is a simulated account for the real market conditions. You will be able to trade in real-time but with simulated money so that you do not risk losing your financial resources. Once you observe that your trades are more successful and exceed the losses, you can open a real trading account with the broker.

After registering your real trading account you need to make your first deposit. There are numerous payment gateways offered by the brokers based on your country of residence. Some of the best payment methods in South Africa are Skrill, PayPal, and M-Pesa. All three are frequently found with high-quality brokerage companies. You can also pay using credit/debit cards or bank wire transfers. After you make your first deposit, your account is activated and you can get started immediately.

Comments (0 comment(s))